SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

WASHINGTON, USA – The Federal Reserve held interest rates steady on Wednesday, November 1, as policymakers struggled to determine whether financial conditions may be tight enough already to control inflation, or whether an economy that continues to outperform expectations may need still more restraint.

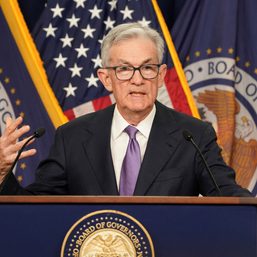

Fed Chair Jerome Powell said the situation remained something of a riddle, with US central bank officials willing to raise rates again if progress on inflation stalls, wary that a rise in market-based interest rates may begin to weigh on the economy in a significant way, and trying not to disrupt, any more than necessary, an ongoing dynamic of steady job and wage growth.

In a press conference after the end of a two-day policy meeting, Powell said the better course of action for now, given the uncertainties, was to maintain the Fed’s benchmark overnight interest rate in the current 5.25%-5.50% range, and see how job and price data evolve between now and the next policy meeting in December.

Roughly 20 months into the Fed’s aggressive tightening of monetary policy, Powell said it remained unclear whether overall financial conditions were yet restrictive enough to tame inflation that he still considers to be far above the central bank’s 2% target.

“We’re not confident that we haven’t, we’re not confident that we have” reached that sufficiently restrictive plateau, Powell told reporters. “Inflation has been coming down, but it’s still running well above our 2% target…. A few months of good data are only the beginning of what it will take to build confidence.”

Annual inflation, based on the Fed’s preferred measure, was 3.4% in September for the third month in a row. Excluding volatile food and energy costs, it was 3.7%, little changed from August.

Asked if the Fed maintained a bias towards hiking rates versus keeping policy on hold, Powell responded “that’s the question we’re asking. Should we hike more?”

Market rates in focus

But the Fed chief also acknowledged that a recent market-driven rise in Treasury bond yields, home mortgage rates, and other financing costs could have their own impact on the economy as long as they persist, and Fed officials will be watching those effects closely as they consider whether to hike the central bank’s policy rate again.

“These higher Treasury yields are showing through to higher borrowing costs for households and businesses. Those higher costs are going to weigh on economic activity to the extent this tightening persists,” Powell said, taking particular note of 30-year fixed-rate home mortgages that are nearing 8%, close to a 25-year high.

Powell’s comments elaborated on a policy decision and statement that, while leaving the Fed’s benchmark rate unchanged for the second consecutive meeting, also took stock of what he called the “outsized” 4.9% annual pace of US economic growth in the July-September period after a surge of consumer spending.

“Economic activity expanded at a strong pace in the third quarter,” the US central bank said in its statement after policymakers unanimously agreed to leave rates unchanged. The language marked an upgrade to the “solid pace” of activity the Fed saw as of its September meeting.

US stocks climbed after the release of the policy statement and closed higher on the day, while the US dollar pared gains and ended flat against a basket of currencies. US Treasury yields fell and traders of short-term US interest rates added to bets the Fed was done raising its policy rate and would start cutting rates by June of next year.

“The statement leans to the dovish side,” said Peter Cardillo, chief market economist at Spartan Capital Securities. “The fact that they left rates unchanged for the second time in a row suggests the Fed might leave rates unchanged in December. And if they do, that means the Fed is done.”

Though markets think the Fed’s rate-hiking campaign may be finished, data pointing to a stronger-than-expected economy and labor market have kept the prospect of another hike on the table.

Powell noted that much about the economy’s recent performance was constructive, with low unemployment and rising wages fueling more demand for goods and services and more job creation – the sort of virtuous cycle that, within bounds, leads to self-sustaining growth.

The issue for the Fed is whether conditions remain so robust that progress on inflation stalls or even reverses.

“It has been good,” Powell said. “We’ve been achieving progress on inflation in the middle of this…. The question is, how long can that continue?”

The odds, he said, are that a slowdown of some sort will be needed, with the Fed committed to finding the policy stance that makes it happen.

“It is still likely…we will need to see some slower growth and some softening in the labor market…to fully restore price stability,” Powell said.

His comments throw the focus onto upcoming employment and inflation data, with the release of the Department of Labor’s monthly jobs report on Friday, November 3 – the first major piece of data that will shape the Fed’s deliberations for its December meeting. – Rappler.com

Add a comment

How does this make you feel?

![[OPINION] A rebellion long overdue](https://www.rappler.com/tachyon/2024/06/mass-uprising-matrix-june-4-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.