SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Correcting misleading claims by ex-president Marcos’ technocrats](https://www.rappler.com/tachyon/2023/05/Sicat-lecture-TL-05192023.jpg)

On Monday, May 15, 2023, the Philippine Center for Economic Development (PCED) – a government agency in support of the UP School of Economics – kicked off a series of lectures to commemorate its 50th anniversary this year.

The speakers are all past directors-general of the National Economic and Development Authority (NEDA), and the talks are scheduled every month of 2023, from May to November.

The inaugural talk on May 15 was made by Dr. Gerardo Sicat, 87, the top economist of the dictator Ferdinand E. Marcos. In 1970, Sicat served as chair of the National Economic Council, and then became the first director-general of NEDA in 1973. These institutions were designed to undertake national planning toward socioeconomic development.

Sicat’s inaugural lecture on May 15 was quite fitting. He left his mark in the economics profession of the country by establishing a number of institutions, including PCED itself, as well as the Philippine Institute for Development Studies (PIDS), the government’s think tank.

He gave a lecture reminiscing about his time in government during the Marcos dictatorship. It was natural to expect him to wax nostalgic. But some claims he made – along with former prime minister Cesar Virata, 92, who was in attendance and in fact one of Sicat’s discussants – unfortunately whitewashed certain aspects of the economy during that time.

The Sicat ‘bump’

For instance, Sicat presented a graph showing the upward trend of national output (measured by GDP or gross domestic product) over time.

He then pointed out that if you run a line across this trend, there was supposedly a “bump above the long-term trend of growth” during his time in office. He added, GDP “for a while it was up there, and then suddenly it drops, and then…for a long time it drops below the long-term trend…”

In short, the economy supposedly grew more rapidly around the time he was in office, and then underperformed starting the Corazon Aquino administration.

This was improper use of statistics and graphs.

Figure 1.

First, running a line across those data points is ill-advised because of a distinct “structural break” in the series around 1984 and 1985, when the Philippine economy suffered its worst postwar recession or downturn in the dying years of Martial Law. (You can read all about that in my book titled, False Nostalgia: The Marcos “Golden Age” Myths and How to Debunk Them.)

The presence of such break in the series would naturally make it appear that GDP was above-average in the 1970s, and below-average in the 1990s onward. Simply, you don’t just connect two separate trends using one trendline. If you implement the proper statistical corrections (which a colleague of mine at UPSE explored recently), such a big bump during Sicat’s time would all but disappear.

‘Ninoy shock’

Sicat also showed another graph showing the growth of GDP over time, but this time labeled the steep decline starting 1983 as the “Ninoy shock,” referring of course to the August 21, 1983, assassination of the former senator.

He then showed alternative scenarios of how GDP would’ve grown had the “Ninoy shock” not happened. He said, “In the year 2000, if the growth path were lower, we would’ve achieved a real GDP…that was equivalent to the real GDP that the country had obtained in the year 2008. So that’s eight years lost in our growth. If it happened that there was a higher growth path, it would’ve been 10 years.”

Figure 2.

Right after presenting this, Sicat became defensive: “Now I’m not posing any judgmental issue here…” He added that he deliberately chose not to focus on it for his talk, because he would “get into trouble” and “so many issues” in the graph may be raised. “I won’t even answer questions if you ask me, what about this and that,” he said.

Here are some of those issues Sicat tried to avoid.

First, there was no explanation how projections he called “low growth path” and “high growth path” were obtained. Also, the lines and points in the graph are unaligned and seem arbitrary.

Second, when speaking about development, economists typically look at GDP per person, not GDP itself. And data show that after dipping in 1982 (even before Ninoy was killed), GDP per person in the country fell and didn’t recover until 2003. That’s 21 years called now the “lost decades of development” – far longer than the eight or 10 years that Sicat showed and attributed to the “Ninoy shock.”

Third, and most importantly, it’s unfair to label the dip in GDP as “Ninoy shock” when in fact the economy was worsening way before Ninoy came back to the country. The seeds of the crisis were planted as early as the mid-1970s. Using such a label conceals the fact that it was the Marcos government that was ultimately responsible for the economic crisis.

Sicat later added that the Ninoy shock “broke the nation’s back,” because after that, “international conference on the Philippine sovereign debt fell apart,” our creditors stopped lending, and we became “alone in the world.”

This is another gross mischaracterization of what had happened. Creditors stopped lending when, in late 1983, after Ninoy’s assassination, the Marcos government declared a debt moratorium. Essentially, the Marcos government said to the world we could no longer pay our debts. That stemmed from the profligate spending and irresponsible debt accumulation of the regime.

Sicat did mention in passing there was “looming” debt, but brushed it aside by citing the experiences of debt-ridden countries like Mexico whose debt crises “passed.”

This is the wrong comparison to make. As Professor Emeritus Emmanuel de Dios wrote back in 2015, “It is instructive that neither Thailand, Indonesia, Malaysia, nor any major Asian country catastrophically experienced negative growth in the early 1980s. The Philippines was the exception…. This suggests that there was nothing unavoidable about the crisis the Philippines suffered, and that it was the result instead of failed policies.”

Using his framing, Sicat downplayed the repercussions of the Marcosian debt crisis which depleted our international reserves, led to the debt moratorium, and fixed with necessary stabilization measures that ignited a full-blown economic crisis.

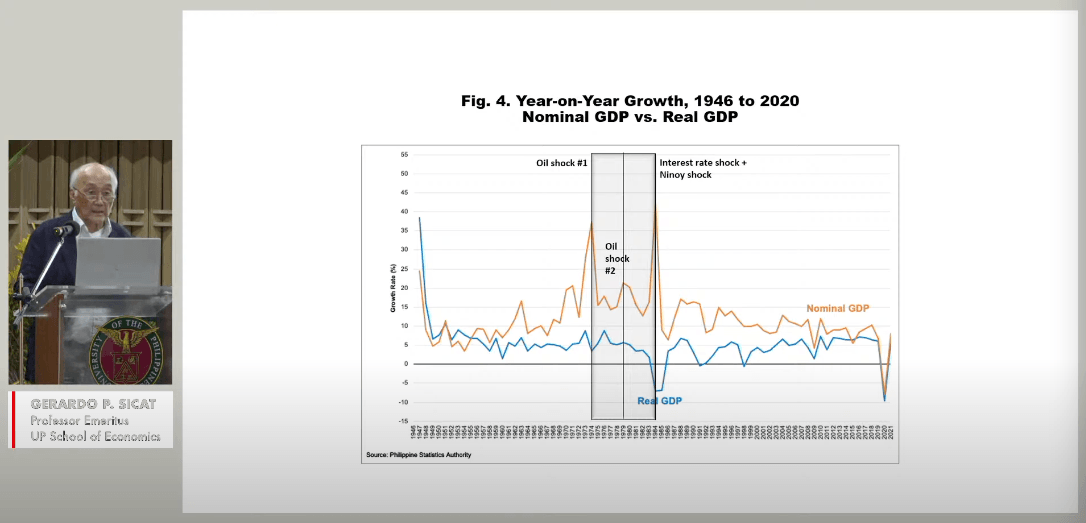

Sicat also put too much emphasis on the economic shocks in the 1970s and 1980s, like the oil price shocks due to OPEC [Organization of the Petroleum Exporting Countries] and the interest rate shock due to the steep rise of interest rates in the US in the early 1980s (Figure 3). He also lumped together the interest rate shock and the “Ninoy shock,” and pointed out that because of these GDP growth even became negative.

This is plainly wrong. GDP dropped by more than 7% not in 1983, but in 1984, then again in 1985. Also, in explaining the recession, there was no mention of the profligate spending and borrowing of the dictatorship, which, more than anything else, eventually brought the nation to its knees.

Figure 3.

Sicat went on by showing another graph of inflation, and here the “biggest shock was the combination of the interest rate shock plus the Ninoy shock.”

Again, this is wrong. Inflation shot up to more than 50% in 1984 largely because of the severe depreciation of the peso due to the conditionalities set by the International Monetary Fund in stabilizing the damaged Marcosian economy.

In the first place, if the technocrats had not allowed the economy to be so mismanaged and debt-ridden, we need not have declared a debt moratorium and we wouldn’t have to be “stabilized” by the IMF.

Figure 4.

For his part, former prime minister Cesar Virata claimed in the Q&A that Philippine debt ballooned because the banks wanted to give us big loans rather than small loans.

He said, “The problem during that time was that the Western banks…would not like to lend small things, they always want to lend big things with the guarantee of the government.” Also, he said the Western banks conspired to bring down the Marcos regime.

Oh, what spin!

Other Martial Law myths

Sicat made other claims about various aspects of Martial Law that also need to be given proper context or outright corrected.

First, he said near the beginning of his lecture that Martial Law was declared because Marcos “discovered, in his own analysis, that the country was in danger and decided Martial Law was the solution.”

But espousing this view only perpetrates Marcos’ dubious justifications for Martial Law. It also masks the truth that Marcos did it primarily to overextend his stay in power.

Second, Sicat proudly listed down a long list of infrastructure projects built during the regime. He even claimed that on a per-year basis, adjusting for the regime’s 21 years, Marcos would probably still be “the best” when it comes to infrastructure.

But he omitted mentioning that many of those infrastructure projects were extravagant, needless, and largely used as vehicles for corruption.

He did mention in passing the notorious white elephant, the Bataan Nuclear Power Plant: “Unfortunately, this…was not put to use by the successor government for political reasons.” No mention of the myriad problems that went into its construction. No mention of the multimillion-dollar commissions earned by Herminio Disini, the crony broker, and ex-president Marcos himself.

Sicat also mentioned the “protected industries” that were “highly indebted to state financial enterprises,” and which he “criticized in [his] academic work.” But he didn’t say that many of the protections and advantages were coming from the dictator himself, and those firms obtained money from the Marcos government at the behest of the former president himself (hence, the term “behest loans”).

In the latter part of his talk, Sicat also bemoaned the OFW phenomenon, saying that we don’t want a situation where our national income (taking into account OFWs’ earnings) is always ahead of GDP. Instead, we want to attract foreign capital and promote domestic economic activity and job creation.

But again he neglected to say that the labor exportation policy was a deliberate policy of the Marcos regime, and in fact people were encouraged to work abroad so that the remittances they sent back to their families could be used to replenish our depleting stocks of dollars – depleting precisely because of the ballooning debt of the regime, among other things.

Whitewashing galore

Sicat did not always see eye-to-eye with Marcos, most notably on the continued protection of domestic industries from international competition. Sicat’s push for liberalization was thwarted by strong lobby by industrialists, many of whom were Marcos cronies. Maybe that’s one reason why he exited the regime in 1980, well ahead of the economic crisis.

But more than 50 years since Martial Law was declared, it’s unfortunate that Marcos’ technocrats are still trying to justify or defend the dictatorship. They are still making it appear that the economy back then was stellar and that many things got worse when Marcos was ousted by the People Power Revolution.

It’s bad enough that the “golden age” myths are being perpetuated by vloggers and trolls, but way worse when done by other economists. – Rappler.com

JC Punongbayan, PhD is an assistant professor at the UP School of Economics and the author of False Nostalgia: The Marcos “Golden Age” Myths and How to Debunk Them. JC’s views are independent of his affiliations. Follow him on Twitter (@jcpunongbayan) and Usapang Econ Podcast.

Add a comment

How does this make you feel?

![[Closer Look] ‘Join Marcos, avert Duterte’ and the danger of expediency](https://www.rappler.com/tachyon/2024/06/TL-trillanes-duterte-expediency-june-29-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[Newspoint] A Freedom Week joke](https://www.rappler.com/tachyon/2024/06/20240614-Filipino-Week-joke-1.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] Raised on radio](https://www.rappler.com/tachyon/2024/04/raised-on-radio.jpg?resize=257%2C257&crop=396px%2C0px%2C720px%2C720px)

![[Just Saying] Marcos: A flat response, a missed opportunity](https://www.rappler.com/tachyon/2024/04/tl-marcos-flat-response-april-16-2024.jpg?resize=257%2C257&crop=277px%2C0px%2C720px%2C720px)

![[In This Economy] Part 2 | POGOnomics: Are we banning POGOs out of fear, outrage, not rational thought?](https://www.rappler.com/tachyon/2024/06/thought-leaders-pogonomics-part-2b.jpg?resize=257%2C257&crop=292px%2C0px%2C720px%2C720px)

![[In This Economy] POGOnomics: Weighing the costs and benefits of POGOs](https://www.rappler.com/tachyon/2024/06/thought-leaders-pogonomics-part-1.jpg?resize=257%2C257&crop=279px%2C0px%2C720px%2C720px)

![[In This Economy] Is the Philippine economy stable?](https://www.rappler.com/tachyon/2024/05/philippine-economy-stable-may-10-2024.jpg?resize=257%2C257&crop=461px%2C0px%2C1080px%2C1080px)

![[In This Economy] Is the Philippines quietly getting richer?](https://www.rappler.com/tachyon/2024/04/20240426-Philippines-quietly-getting-richer.jpg?resize=257%2C257&crop=194px%2C0px%2C720px%2C720px)

![[Vantage Point] Joey Salceda says 8% GDP growth attainable](https://www.rappler.com/tachyon/2024/04/tl-salceda-gdp-growth-04192024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.