SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Editor’s note: This content is sponsored by Chinabank and was produced by BrandRap, the sales and marketing arm of Rappler. No member of the news and editorial team participated in the publishing of this piece.

Let’s face it – everything we need to do; we want to do online. From paying our bills and getting groceries to buying ready-to-eat food and other essential items. It’s just more convenient and it saves us so much time. No need to wait in long lines or get stuck in traffic.

For Chinabank customers, online transactions just got more convenient. As the bank adapts embedded banking to non-bank apps and websites, customers’ payment capabilities are expanded, making online transactions even smoother. Customers may now transact with an even more diverse range of options across various merchant and service categories, from food and clothing to electronics and furniture, as well as booking hotels, wellness packages, and even paying for bills or school fees.

This was made possible by the partnership between Chinabank and Xendit Philippines, a leading payments infrastructure provider for enterprises, startups, and SMEs. Chinabank entered this partnership in response to its customers’ growing need for digital payment solutions.

“Chinabank’s move to introduce embedded banking demonstrates its recognition of the shifting payment landscape and the customers’ evolving preferences,” said Chinabank Chief Transformation Officer Dr. Delfin Jay Sabido IX. “We want to be part of our customers’ everyday financial decisions and transactions, which is why we are providing them a more integrated and streamlined payment experience.”

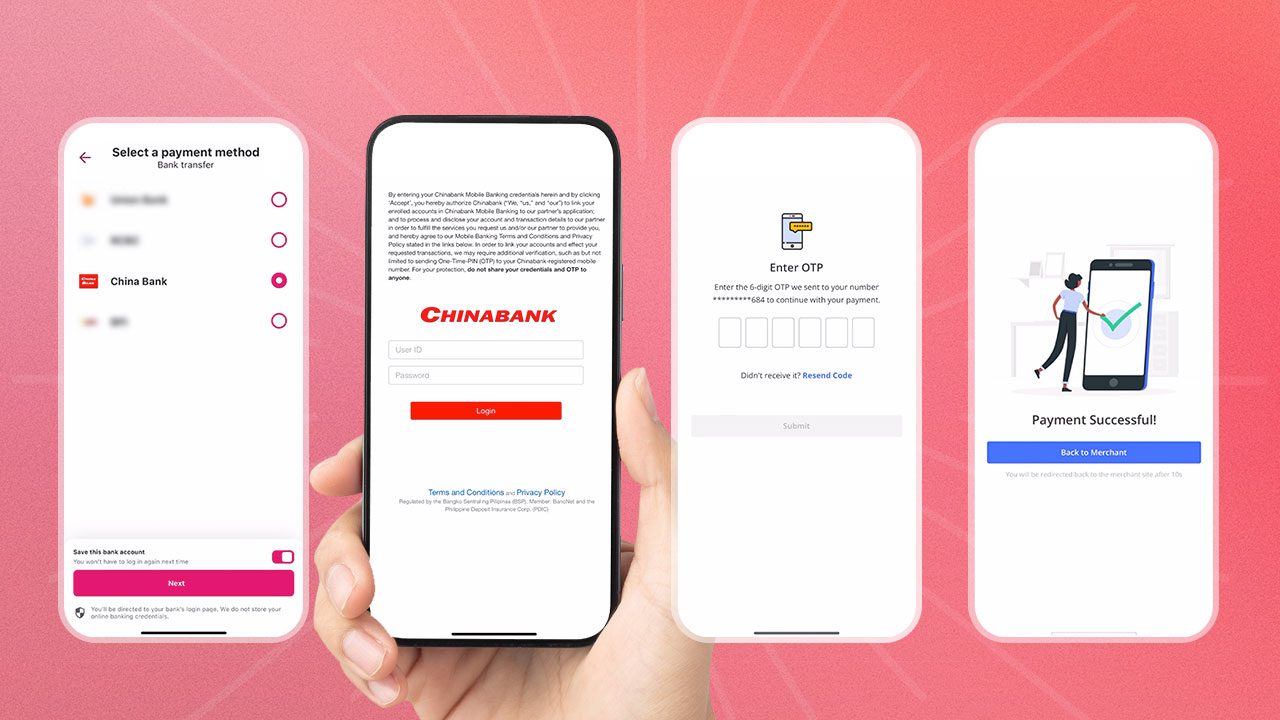

Chinabank’s Digital Payment service is useful for customers who don’t own or do not want to use their debit cards, credit cards, or e-wallets for online purchases. To use, customers simply need to enter their Chinabank Mobile Banking credentials to pay directly from their account. This service is supported by multifactor authentication to ensure secure digital transactions.

A special offer also awaits Chinabank customers who will be using this service! In celebration of the bank’s 103rd anniversary, eligible customers will receive a unique foodpanda discount voucher worth P103. The promo will run from August 22 to 31, 2023.

For more information about Chinabank Digital Payment, visit https://www.chinabank.ph/china-bank-digital-mobile-payments. To know more about the special offer, see https://www.chinabank.ph/china-bank-103-anniversary-promo-with-foodpanda.

Happy shopping! – Rappler.com

Add a comment

How does this make you feel?

![[Finterest] Private banking: How the wealthy keep the money within the family](https://www.rappler.com/tachyon/2024/07/Finterest-wealth-between-the-family.jpg?resize=257%2C257&crop=425px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.