SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] The Marcos family’s estate tax liability](https://www.rappler.com/tachyon/2022/04/tax-whiz-marcos-family-estate-tax-evasion.jpg)

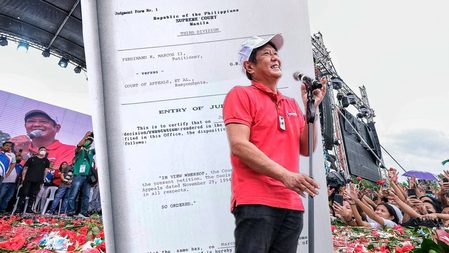

On December 2, 2021, presidential candidate Ferdinand Marcos Jr. and his family received a written demand from the Bureau of Internal Revenue (BIR) to settle their estate tax liability amounting to a staggering P203 billion. How did the estate tax of the Marcos family balloon to such a huge amount?

The basic estate tax due, assessed by the BIR on July 26, 1991, was P23 billion. This deficiency tax assessment became final and unappealable when the Marcos family failed to file a protest within 30 days.

The applicable interest rate is 20% per year. More than 30 years after the death of former dictator Ferdinand Marcos, the annual interest continues to accumulate as the estate tax liability remains unpaid.

In a statement, Marcos Jr.’s spokesperson claimed that the tax case is “still pending in court and the ownership of the properties in litigation has yet to be settled.” Is this accurate?

No. On June 5, 1997, the Supreme Court affirmed the decision of the Court of Appeals on the matter. The ruling became final and executory on March 9, 1999, based on the SC’s entry of judgment.

Any decision on the alleged ill-gotten wealth under litigation is separate and will not affect or change the estate tax liability of the Marcos family.

Is this all about politics since Marcos Jr. is running for president in the May 2022 elections?

Definitely not. It’s a matter of fact that the estate tax liability remains unsettled. While it was the political party of presidential candidate Manila Mayor Isko Moreno who wrote to the BIR to inquire about the estate tax liability of the Marcos family, it was former Supreme Court senior associate justice Antonio Carpio who first wrote about the tax debt involving the Marcos estate in his Inquirer article on September 30, 2021.

It’s no surprise this was raised during presidential debates which Marcos Jr. refused to attend. He could have explained himself to the public during the debates rather than let other presidential candidates use the issue against him.

Was the verbal agreement between the BIR and the Presidential Commission on Good Government (PCGG) used “to determine with accuracy the fair and just tax base to be used in computing estate taxes”?

No. On January 13, 2003, there was a verbal understanding between the BIR commissioner and then-PCGG chairperson Haydee Yorac as well as then-commissioners Ruben Carranza, Victoria Avena, William Dichosa, and Maria Gracia Pulido Tan, for the BIR to enforce its assessment and collection of the estate tax due on all Marcos assets in accordance with Section 206 of the National Internal Revenue Code (NIRC), except on those that are sequestered or subject of a recovery case by the PCGG, and the Swiss funds under escrow by the Philippine National Bank. According to the PCGG, the reasons for the agreement were:

- Pending resolution of the sequestration/cases, such assets and properties are not “indubitably included” in the Marcos estate

- By having sequestered/sued for the assets, the government has legally laid claim on them, and should the government’s claims be upheld by the courts, the BIR would have in effect satisfied tax claims of the government involving properties of the government itself instead of properties of the delinquent taxpayers

Furthermore, the PCGG reiterated that “it may not be accurate to state that the said agreement was ‘to determine with accuracy the fair and just tax base to be used in computing estate taxes, if any,'” because as early as 1993, the BIR already executed its final assessment when it levied and sold 11 real properties in Tacloban City, and in 1999, the SC judgment on the tax case had become final and executory.

In an interview, retired justice Carpio encouraged the BIR to file a criminal case against the Marcos family over their “willful refusal” to pay their estate tax liability. Apparently, the BIR has resorted to only levying real properties of the Marcoses to enforce collection. Under the tax code, can the BIR simultaneously file criminal charges? Can the Marcoses go to jail?

Yes, the BIR can file criminal charges and the Marcoses, if found guilty, could go to jail.

Under Section 205 of the tax code on civil remedies, (1) a warrant of distraint and/or levy and (2) civil or criminal action may be exercised simultaneously. The judgment in the criminal case shall not only impose the penalty but shall also order payment of the taxes.

Under Section 254 of the tax code, any person who willfully attempts to evade tax shall be punished by a fine of not less than P500,000 but not more than P10 million and suffer imprisonment of not less than 6 years but not more than 10 years.

In a Facebook post, former BIR commissioner Kim Henares said the Marcos family can still avail of estate tax amnesty until June 14, 2023. Is that correct?

No. Under Republic Act No. 11213 or the Tax Amnesty Act, estate tax amnesty shall not extend to delinquent estate tax liabilities which have become final and executory.

Properties involved in the following cases pending in courts are also not qualified for estate tax amnesty:

(a) Falling under the jurisdiction of the PCGG

(b) Involving unexplained or unlawfully acquired wealth under the Anti-Graft and Corrupt Practices Act (Republic Act No. 3019) or An Act Defining and Penalizing the Crime of Plunder (Republic Act No. 7080)

(c) Involving violations of the Anti-Money Laundering Act (Republic Act No. 9160)

(d) Involving tax evasion and other criminal offenses under Chapter II of Title X of the NIRC of 1997, as amended

(e) Involving felonies of frauds, illegal exactions, and transactions, and malversation of public funds and property under Chapters III and IV of Title VII of the Revised Penal Code

– Rappler.com

Mon Abrea, CPA, MBA, is the co-chair of the Paying Taxes-EODB Task Force. With the TaxWhizPH mobile app as his brainchild, he was recognized as one of the Outstanding Young Persons of the World, an Asia CEO Young Leader, and one of the Ten Outstanding Young Men of the Philippines because of his tax advocacy and expertise. Currently, he is the chairman and CEO of the Asian Consulting Group and trustee of the Center for Strategic Reforms of the Philippines – the advocacy partner of the Bureau of Internal Revenue, Department of Trade and Industry, and Anti-Red Tape Authority on ease of doing business and tax reform. Visit www.acg.ph for more information or email him at mon@acg.ph and download the TaxWhizPH app for free if you have tax questions.

Add a comment

How does this make you feel?

![[Ask the Tax Whiz] Withholding tax under Ease of Paying Taxes law](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg?resize=257%2C257&crop=205px%2C0px%2C900px%2C900px)

![[OPINION] If it’s Tuesday it must be Belgium – travels make over the Marcos image](https://www.rappler.com/tachyon/2024/04/tl-travel-makeovers-marcos-image.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.