SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] Is there any extension for business permit renewal?](https://www.rappler.com/tachyon/2022/01/tax-whiz-january-30-2022.jpg)

When is the deadline for the renewal of business permits? Since COVID-19 cases remain relatively high, is there any extension in the deadline for business permit renewal for 2022?

Section 167 of the Local Government Code states: “Unless otherwise provided in this Code, all local taxes, fees, and charges shall be paid within the first twenty (20) days of January or of each subsequent quarter, as the case may be. The sanggunian concerned may, for a justifiable reason or cause, extend the time for payment of such taxes, fees, or charges without surcharges or penalties, but only for a period not exceeding six (6) months.”

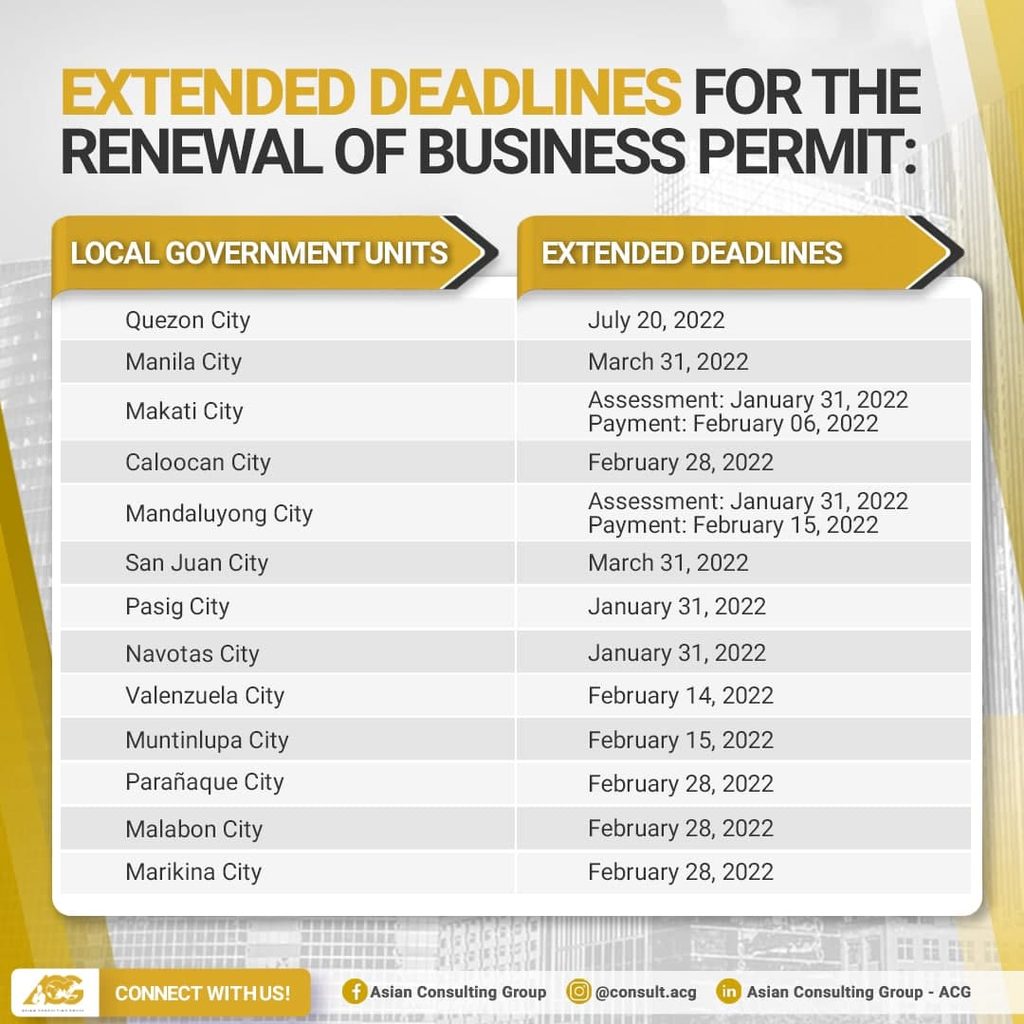

As of January 19, 2022, the following local government units (LGUs) have extended the deadline for the renewal of business permits:

Before securing their business permit, businesses first need to pay local business tax (LBT). What is the basis for the computation?

Under Section 143 of the Local Government Code, the basis for the computation of LBT should be the gross receipts or sales in the immediately preceding taxable year. If the current taxable year is 2022, the basis should be the gross receipts or sales from 2021. The rate of the LBT varies depending on the nature and industry of the taxpayer.

Since the audited financial statement for 2022 is not yet available as of the deadline of the renewal, the LBT shall be based on the sworn declaration of gross sales/receipts, income tax return, or value-added tax.

The assessment of my local tax for this year increased by 10%. Is it valid to impose such a rate? What is the legal basis for the additional tax? Are there any available remedies for businesses in case they do not agree with the assessment of LBT?

Some LGUs imposed an additional 10% to 15% in local taxes to increase collections and meet their targets, but LGUs cannot practice this without any legal basis. If you do not agree with the assessment of your LBT, you have to file a written protest within 60 days from receipt of assessment. This applies whether you pay or not. In case you already paid the assessment but you did not file a protest within 60 days, you can no longer seek a refund because non-filing of a protest would make the assessment conclusive.

To know your business’ tax compliance risk level, avail of our free Annual Tax Health Check! Register through this link or by scanning the QR code below. You may also email us at consult@acg.ph or contact (+63)9178010191 to book a consultation.

– Rappler.com

Mon Abrea, CPA, MBA, is the co-chair of the Paying Taxes-EODB Task Force. With the TaxWhizPH mobile app as his brainchild, he was recognized as one of the Outstanding Young Persons of the World, an Asia CEO Young Leader, and one of the Ten Outstanding Young Men of the Philippines because of his tax advocacy and expertise. Currently, he is the chairman and CEO of the Asian Consulting Group and trustee of the Center for Strategic Reforms of the Philippines – the advocacy partner of the Bureau of Internal Revenue, Department of Trade and Industry, and Anti-Red Tape Authority on ease of doing business and tax reform. Visit www.acg.ph for more information or email him at mon@acg.ph and download the TaxWhizPH app for free if you have tax questions.

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] Are cross-border services taxed in the Philippines?](https://www.rappler.com/tachyon/2024/02/bpo-workers.png?resize=257%2C257&crop=72px%2C0px%2C785px%2C785px)

![[Ask the Tax Whiz] Ease of paying taxes law: What you need to know](https://www.rappler.com/tachyon/2023/02/calculate-february-22-2023.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.