SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

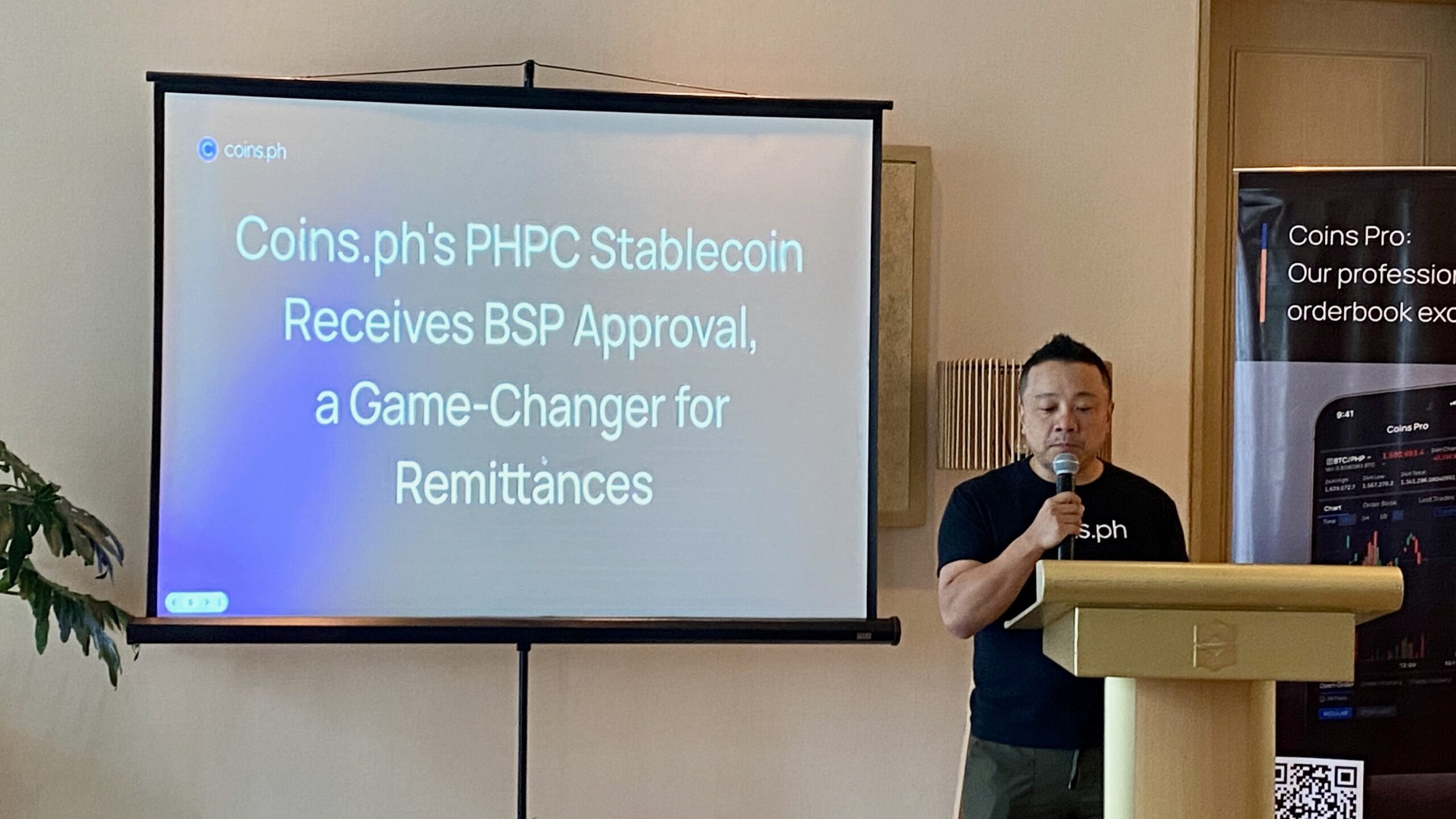

MANILA, Philippines – Local cryptocurrency exchange Coins.ph has obtained approval to issue the Philippines’ first stablecoin, called “PHPC.”

As a stablecoin, PHPC will be pegged 1:1 to the Philippine peso. This means that users of the token are not subjected to the volatile swings in market value that other cryptocurrencies like Bitcoin experience.

According to Coins.ph, PHPC is fully backed by cash and cash equivalents stored in local bank accounts. Once it launches, PHPC will become the first Philippine peso stablecoin available for retail use.

After being given the green light by the Bangko Sentral ng Pilipinas (BSP), Coins.ph is now preparing to issue PHPC and list it on its crypto exchange by early June as part of an early public test period.

Coins.ph chief executive officer Wei Zhou said that there were “certain limitations in the sandbox environment,” but that Coins.ph was targeting to reach 20,000 to 30,000 users during the first month of launch.

Coins.ph has been in discussion with the BSP about its stablecoin initiative for about a year, Zhou disclosed. The central bank is also piloting its own central bank digital currency under its “Project Agila” project.

Stablecoins for remittance

A big target use case for PHPC is remittance. Sending money across borders using crypto is cheaper than using traditional remittance channels, like banks and “pera padala” centers. It is also available 24/7.

OFWs often use US dollar-pegged stablecoins to remit money, but this comes with extra steps and costs of having to convert the US dollars received into Philippine pesos. With a peso-pegged stablecoin like PHPC, it’s more convenient.

“Your relative here that’s receiving the money doesn’t have to convert the US dollar that he receives into pesos,” Zhou said.

Zhou also said that Coins.ph is planning to make PHPC available in other crypto exchanges as well to make the stablecoin more accessible.

“You can imagine that if the PHPC is listed on our partner exchanges in, say, Australia, or Singapore, or the US, then basically our family and remittance senders can actually purchase the PHPC and actually send it directly to the wallets here at coins.ph,” Zhou said.

Early in 2024, Coins.ph announced its plans to expand operations to Europe, Latin America, Australia, and Africa, with the idea of enabling overseas Filipino workers to send their remittances home using crypto. – Rappler.com

Add a comment

How does this make you feel?

![[Finterest] What is cryptocurrency, and what’s with the hype?](https://www.rappler.com/tachyon/2023/12/crypto-money-laundering-reuters-scaled.jpg?fit=449%2C449)

![[Finterest] Is a digital bank safe, and how can you best use it?](https://www.rappler.com/tachyon/2024/05/digital-banks-safety-may-11-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.