SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

WASHINGTON, USA – Jeffrey Haley, the chief executive officer of American National Bank and Trust Company, saw the crunch coming at the start of 2023.

Rising interest rates and a slowing economy to him meant that loan growth would likely fall by half as the Danville, Virginia-based community bank turned its focus to better-quality, higher-yielding credit, worrying little about volume.

Then a pair of US regional banks abruptly failed in mid-March. Instinct told him things would tighten further, with loan growth plunging to perhaps a quarter of what it was in 2022, when his bank’s loan book grew by 13% to around $2.1 billion.

Coming into 2023 “my rule of thumb was whatever you did last year you will probably do half this year,” Haley said. “Based on current events…I now think it gets cut in half again.”

After a year of racing along a virtually unfettered path to higher interest rates, the Federal Reserve is facing its first significant pothole as the decisions made in hundreds of bank executive suites will either add up – or not – to an economy-shaping drop in lending.

By raising the benchmark interest rate that banks use in lending money to each other, tighter monetary policy makes consumer and business loans more expensive and harder to get. In theory, that lowers demand for credit-financed goods and services, and in time also lowers inflation.

The concern now is how far and fast that unfolds.

Household and business bank accounts remain comparatively flush, a buffer against too swift an economic comedown.

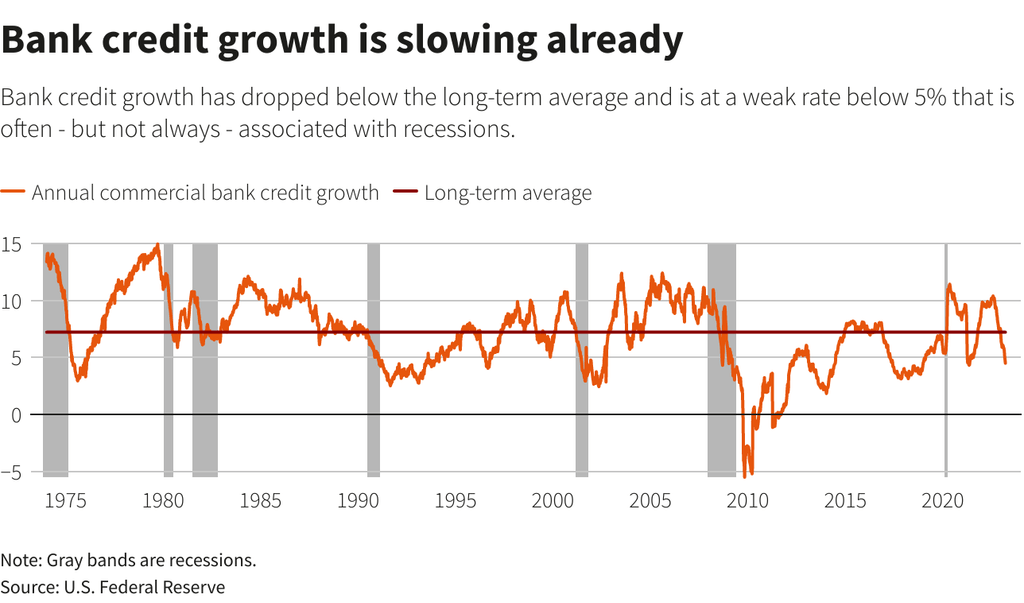

But overall bank credit has been stalled at about $17.5 trillion since January. Its year-over-year growth has been falling fast, and the Fed’s next interest rate decision in May now hinges on whether policymakers decide that’s just monetary policy running its course or something deeper.

Rattled cage

Inflation, as measured by the Fed’s preferred gauge, remains more than double the US central bank’s 2% target, and for now policymakers seem agreed that another rate increase at their May 2-3 meeting is warranted.

But the potential for a worse-than-expected credit crunch remains elevated in the wake of the Silicon Valley Bank and Signature Bank collapses last month, which raised concerns of a larger financial panic.

The worst seems to have been avoided. Emergency steps by the Fed and Treasury Department protected depositors at both banks, helping ease what could have been a destabilizing run from smaller banks to larger ones. Other actions by the Fed helped maintain confidence in the wider banking system.

Yet the cage was rattled as a year of rising interest rates had already put smaller banks under pressure, competing for deposits that were leaking into Treasury bonds and money market funds that paid more interest.

The response – less lending, tighter credit standards, and higher interest on loans – was already taking shape. Officials are now watching for signs that has been kicked into overdrive.

Hard data on bank lending and credit will come into play, augmenting top-line statistics like unemployment and inflation that the Fed is focused on. As Fed policymakers gauge whether tougher bank lending may let the central bank forego future rate hikes, bank officer surveys will also be mined for clues about sentiment among those driving credit decisions.

Updated results for one, the Fed’s quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices, will be presented at the central bank’s next meeting before being released publicly the following week – among the more-anticipated editions of a poll that gets little attention outside the most intent of Fed watchers and financial industry analysts.

“Survey data is going to be very important because it’s going to give us a sense of whether financial institutions are pulling back even more on their credit standards,” Cleveland Fed President Loretta Mester said last week. “We already saw it happening, which you’d expect to see as interest rates moved up…. That was kind of a normal thing.”

“Now we’re going to be really assessing, okay, is this even a stronger impact, because that’s going to matter…. We’re trying to calibrate our monetary policy, and tightening credit conditions is the mechanism through which that’s going to impact the broader economy.”

Sentiment weakening

The survey of large and small banks asks high-level questions – Are lending standards tighter or looser? Is loan demand increasing or decreasing? – yet is considered a reliable gauge of how lending will behave.

It was already showing the wheels of a slowdown in motion.

Results for the last quarter of 2022 showed a net share of around 45% of banks were tightening standards for commercial and industrial loans, the survey question seen as the best barometer for the direction of lending. Up sharply in the last three surveys, that is already near levels associated with recession.

Some consumer loan standards were also getting stricter.

Other banking survey data has also turned down.

A Conference of State Bank Supervisors survey found the lowest sentiment among community bankers since the poll began in 2019. Nearly all of the 330 respondents, some 94%, said a recession had already begun.

A Dallas Fed bank conditions survey, conducted in late March after the two bank failures, indicated lending standards in that Fed regional bank’s district have kept tightening, with loan demand falling.

What this means for consumption, business investment, and inflation “remains difficult to gauge,” wrote Peter Williams, director of global policy strategy at ISI Evercore. “This latest shock will add another, challenging-to-model, layer to the outlook.”

Tighter credit is hitting an already-slowing economy, with key sectors showing stress.

Small businesses are already reporting tightened profit margins, a recent Bank of America study found. With their reliance on bank loans, lines of credit, and credit cards, tougher financing conditions may land particularly hard on that segment of the economy, a key source of employment.

Matthew Luzzetti, chief US economist for Deutsche Bank, recently estimated if the next Fed loan officers survey shows a 10-percentage-point rise in the share of banks tightening credit, it could lop about half a percentage point from US output – enough to turn expected meager growth into a recession.

“These scenarios would push lending conditions into a range that has more clearly been associated with recession,” Luzzetti and his team wrote, saying they see potential for “a broader tightening of financial conditions that will meaningfully slow growth at a time when recession risks were already elevated.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.