SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Inflation went down for the third straight month to 3.9% in December 2023, the Philippine Statistics Authority reported on Friday, January 5.

December’s figure is lower than the 4.1% inflation rate observed in November, and is the lowest for the entire 2023.

Despite the December slowdown, average inflation in 2023 still reached 6%, which is above the government’s target band of 2% to 4%.

National Statistician Dennis Mapa said in a briefing on Friday that December’s lower rate was mainly driven by easing inflation in housing, water, electricity, gas, and other fuels (from 2.5% in November to 1.5% in December), as well as food and non-alcoholic beverages (from 5.7% to 5.4%).

The National Economic and Development Authority (NEDA) also noted in a statement that “inflation for most commodity groups either slowed down or retained their previous rates during the month.”

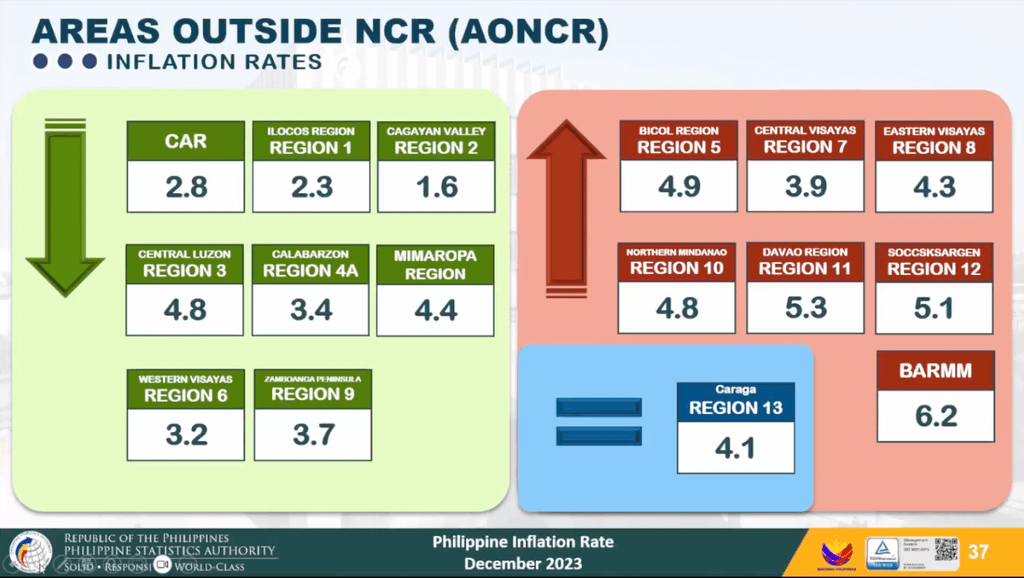

In the National Capital Region, inflation fell from 4.2% to 3.5%, while in areas outside NCR, it slightly eased from 4.1% to 4%.

The Bangsamoro Autonomous Region in Muslim Mindanao posted the highest inflation rate in December at 6.2%, higher than its November figure of 5.9%. Cagayan Valley had the lowest, with inflation there easing from 2.4% to 1.6%.

Spiking rice prices

Consumers felt the price pain brought by persistent inflation throughout 2023, with inflation spiking to 8.7% to start the year – the highest rate since November 2008’s 9.1%. Rice inflation also surged to 17.9% in September 2023.

Rice inflation remained a problem until the end of the year, rising to a new 14-year high of 19.6% in December from 15.8% in November, the highest since March 2009’s 22.9%.

“It was also the most significant contributor to December 2023’s inflation with 1.7 percentage points, followed by food and beverages services and housing rentals with 0.5 ppt each,” added NEDA.

NEDA Secretary Arsenio Balisacan said economic managers will look into proposing “further temporary tariff adjustments” and “measures to reduce other non-tariff barriers,” citing higher global prices of rice and the El Niño phenomenon, which is seen to trigger dry spells and droughts in parts of the Philippines.

“While our medium-term objective to boost agricultural productivity remains, it is important to augment domestic supply to ease inflationary pressures on consumers, particularly those in low-income households,” Balisacan said.

A majority of Filipinos (56%) said they disapproved of how the Marcos administration has tried to control inflation, according to a Pulse Asia survey. Analysts also pointed to inflation as being one of the factors behind President Ferdinand Marcos Jr.’s double-digit drop in approval ratings.

Central bank forecasts

The Bangko Sentral ng Pilipinas (BSP) earlier projected inflation for December 2023 would settle within the range of 3.6% to 4.4%. The central bank cited higher prices of rice and meat as the main drivers that pushed up inflation, while falling electricity and fuel prices helped ease price pressures.

In its fight to control inflation, the BSP also kept its key policy rate steady at 6.5% in its last monetary policy meeting of 2023, with Governor Eli Remolona Jr. saying that rates won’t go down until inflation settles “comfortably” within the government’s target range. (READ: Bangko Sentral not easing rates until inflation settles in 2%-4% range)

The BSP’s latest estimates show inflation could fall “quite low” to below 3% in the early part of 2024. Base effects could then push inflation up to about 4% midyear. After this, the central bank hopes that inflation will settle within the 2% to 4% target range for the rest of 2024. – Rappler.com

Add a comment

How does this make you feel?

![[In This Economy] Is the Philippine economy stable?](https://www.rappler.com/tachyon/2024/05/philippine-economy-stable-may-10-2024.jpg?resize=257%2C257&crop=461px%2C0px%2C1080px%2C1080px)

![[Vantage Point] Philippine economic reforms run into headwinds](https://www.rappler.com/tachyon/2024/05/ph-economic-headwind-may-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] El Niño-nomics: How intense heat is drying up the Philippine economy](https://www.rappler.com/tachyon/2024/05/TL-El-nino-nomics-May-3-2024.jpg?resize=257%2C257&crop=264px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.