SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine government on Monday, November 27, announced the launch of its maiden sukuk bonds issue.

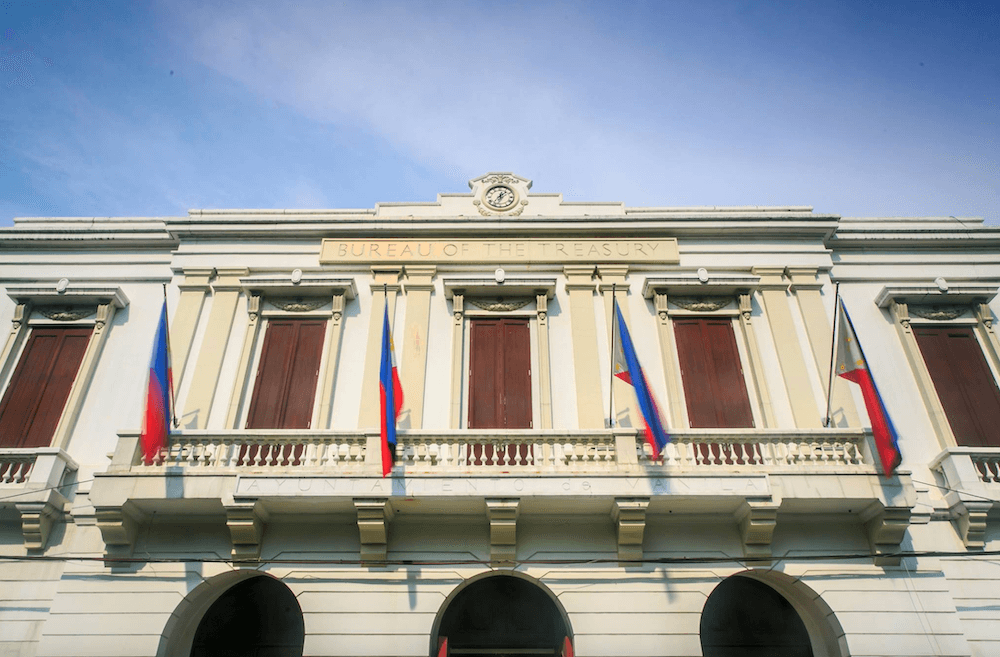

The sukuk bonds offering will have a 5.5-year tenor. The Bureau of the Treasury did not announce in its press release how much it is aiming to raise.

Finance Secretary Benjamin Diokno earlier told reporters that the government aimed to raise $1 billion from the debt issue.

The Philippines mandated Citigroup, Deutsche Bank, Dubai Islamic Bank, HSBC, MUFG, and Standard Chartered Bank as joint bookrunners and joint lead managers to arrange a series of fixed income investor calls in Asia, Europe, the Middle East, and the United States starting Monday.

A sukuk bond is a financial instrument that complies with Islamic principles. Instead of paying interest, sukuk bonds are typically structured as certificates with asset backing. Returns to investors come from the income generated by the underlying assets.

The Philippines intends to borrow P2.46 trillion or around $44 billion to fund the 2024 budget. Of the borrowings, 25% will come from overseas sources and 75% domestically. – Rappler.com

Add a comment

How does this make you feel?

![[EDITORIAL] Apat na taon na lang Ginoong Marcos, ‘di na puwede ang papetiks-petiks](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2024-sona-day-carousel.jpg?resize=257%2C257&crop=280px%2C0px%2C720px%2C720px)

![[In This Economy] Delulunomics: Kailan magiging upper-middle income country ang Pilipinas?](https://www.rappler.com/tachyon/2024/07/in-this-economy-upper-middle-income-country.jpg?resize=257%2C257&crop=421px%2C0px%2C1080px%2C1080px)

![[EDITORIAL] Marcos Year 2: Hilong-talilong](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2nd-sona-carousel.jpg?resize=257%2C257&crop=136px%2C0px%2C720px%2C720px)

![[Newspoint] A fighting presence](https://www.rappler.com/tachyon/2024/07/thought-leaders-a-fighting-presence.jpg?resize=257%2C257&crop=441px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.