SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

In a continuing effort to step up digital corporate banking experience, the Bank of the Philippine Islands (BPI) rolled out the new Mobile Check Deposit facility in the BPI BizLink app – the Bank’s digital banking portal which provides financial management solutions for large corporations – that would enable its corporate clients to conveniently deposit checks using their mobile device with a built-in camera.

This is great news for existing Bizlink users as they can already deposit local and manager’s checks from BPI and other local banks with just a few taps on the easy-to-use mobile app, offering them the flexibility to transact anytime, anywhere. It’s cost- and time-efficient as they need not spend on gas or fare and travel to a BPI branch to deposit checks over the counter.

“We are making the BPI BizLink app as accessible, convenient, and powerful as possible so that our corporate clients can do more transactions efficiently, saving time and reducing costs,” said John-C Syquia, BPI Institutional Banking head.

“This development emphasizes the great advantage of digital banking and is part of our move to bring banking closer to our clients by bundling important products and services in one app.”

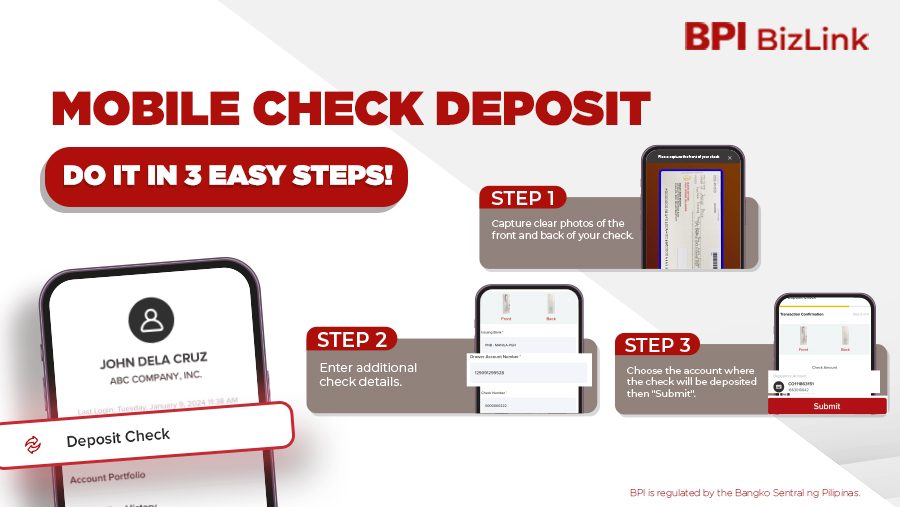

To access this new facility, enrolled clients simply need to do these 3 easy steps:

Step 1: Upon log-in, tap “Deposit Check” in the Menu Bar.

Step 2: Take a clear photo of the front and back of the check and input additional details.

Step 3: Choose the account where the check will be deposited to, then click “Submit.”

Depositors can also access detailed transaction reports through BizLink’s website and mobile app and receive email notifications for checks with relevant status updates, giving clients an increased sense of security and ensuring they know what’s going on in their accounts.

With the Mobile Check Deposit facility, BPI hopes to have more corporate customers enroll on the BizLink app for a better digital banking experience. Syquia added, “At BPI, we continue to be guided by our core values in delivering our commitment to better serve our clients. As the pioneer bank in the country, we assure our clients that we will continue to be dependable and innovative as we double down on our digitalization efforts, doing more in pursuit of our vision to build a better Philippines – one family, one community at a time.”

The BizLink app can be downloaded for free via the App Store or Google Play. With BizLink, clients can also view account balances and transactions, collect payments from enrolled payors anytime, pay bills and transfer funds, and pay employees and suppliers.

Not yet enrolled to BizLink? Simply visit www.bpi.com.ph, search for “BizLink” and view BizLink page, download the BizLink Enrollment Form, and email the accomplished form to bizlink@bpi.com.ph. You may also call the BPI BizLink hotline at (02) 8790-1400 from 8:30 am to 8:30 pm (banking days only) or visit the nearest BPI branch for further assistance. – Rappler.com

PRESS RELEASE

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.