SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Bangko Sentral ng Pilipinas (BSP) is implementing another hike in interest rates as it tries to slow down inflation.

In a rate-setting meeting on Thursday, March 23, the BSP’s Monetary Board raised its key policy rate by 25 basis points (bps), bringing it to 6.25%.

The increase will take effect on Friday, March 24, and will push up the central bank’s interest rates on the overnight deposit and lending facilities to 5.75% and 6.75%, respectively.

“With core inflation rising in February despite a modest decline in headline inflation, further monetary policy action was deemed necessary to address broadening price impulses emanating from robust domestic demand and lingering supply-side constraints,” the Monetary Board said in a press release on Thursday.

The central bank’s inflation outlook for 2023 and 2024 remains elevated, as it sees supply shortages in domestic food prices, higher transport fares, and rising electricity rates.

BSP projections show average inflation could hit 6% in 2023 before falling within the 2%-4% target band at 2.9% in 2024.

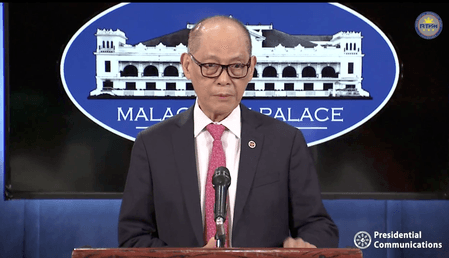

“Anchoring inflation is our highest priority,” BSP Governor Felipe Medalla said during a press conference on Thursday. “Our actions will be almost completely driven by our outlook on inflation.”

Recently, a spate of global bank failures also raised concerns about the continued stability of the Philippine banking system.

But Medalla is not worried about bank woes in the United States spilling over to the Philippines, emphasizing that the balance sheets of local banks are “strong.”

“Banking problems in the rich countries will not have large effects on the Philippine banking system,” he said.

The BSP also said the continued tightening of monetary policy would “preserve the buffer against external spillovers amid heightened uncertainty and volatility emanating from financial sector distress in advanced economies.” – Rappler.com

Add a comment

How does this make you feel?

![[EDITORIAL] Apat na taon na lang Ginoong Marcos, ‘di na puwede ang papetiks-petiks](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2024-sona-day-carousel.jpg?resize=257%2C257&crop=280px%2C0px%2C720px%2C720px)

![[In This Economy] Delulunomics: Kailan magiging upper-middle income country ang Pilipinas?](https://www.rappler.com/tachyon/2024/07/in-this-economy-upper-middle-income-country.jpg?resize=257%2C257&crop=421px%2C0px%2C1080px%2C1080px)

![[EDITORIAL] Marcos Year 2: Hilong-talilong](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2nd-sona-carousel.jpg?resize=257%2C257&crop=136px%2C0px%2C720px%2C720px)

![[Newspoint] A fighting presence](https://www.rappler.com/tachyon/2024/07/thought-leaders-a-fighting-presence.jpg?resize=257%2C257&crop=441px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.