SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The month of December is the most wonderful time of the year for many. It’s often accompanied by holiday cheer, family gatherings, gift-giving, and extra cash with the release of the 13th month pay for those in the formal economy. But what exactly is this benefit and how much can an employee receive it?

The 13th month pay is a mandatory benefit for all employed workers as mandated by Presidential Decree No. 851 in 1976. Employees are entitled to receive another month’s salary as prescribed by law.

Who are entitled to it?

The Department of Labor and Employment (DOLE) on November 10 reminded employers in the private sector through a labor advisory to release this benefit before Christmas Eve. The advisory says all rank-and-file employees in the private sector, who have worked for at least a month for the year, shall receive their 13th month benefit regardless of their position, designation, or employment status, and irrespective of the method by which they are paid.

Employees who are paid on a piece-rate basis, fixed or guaranteed wage plus commission, those with multiple employers, those who resigned, were terminated from employment, or were on maternity leave and received salary differential, should receive theirs too.

DOLE reminded employers that no exemption from payment or deferment of its payment shall be accepted or allowed.

Who are not entitled to it?

Workers in the informal economy, such as unpaid family workers, self-employed workers, are not entitled to this benefit. Based on the latest labor force survey of the Philippine Statistics Authority (PSA), around 16.82 million Filipinos belong to the informal economy. Among them are subsistence farmers and fisherfolk, vendors, construction workers (e.g., carpenters, painters, plumbers, electricians) hired informally, usually for short-term projects, most drivers of public jeepneys and tricycles, and the like.

How much can you get?

The law provides that the 13th month benefit shall not be less than one-twelfth of the total basic salary earned by an employee within a year. Basically, if you have been working since January until now with a monthly basic salary of P25,000, you are entitled to receive P25,000, too, as benefit.

But what if you started working only midyear? Will you be receiving a full month’s worth in extra pay? The answer is no because your 13th month pay will have to be pro-rated. How much will you be receiving then?

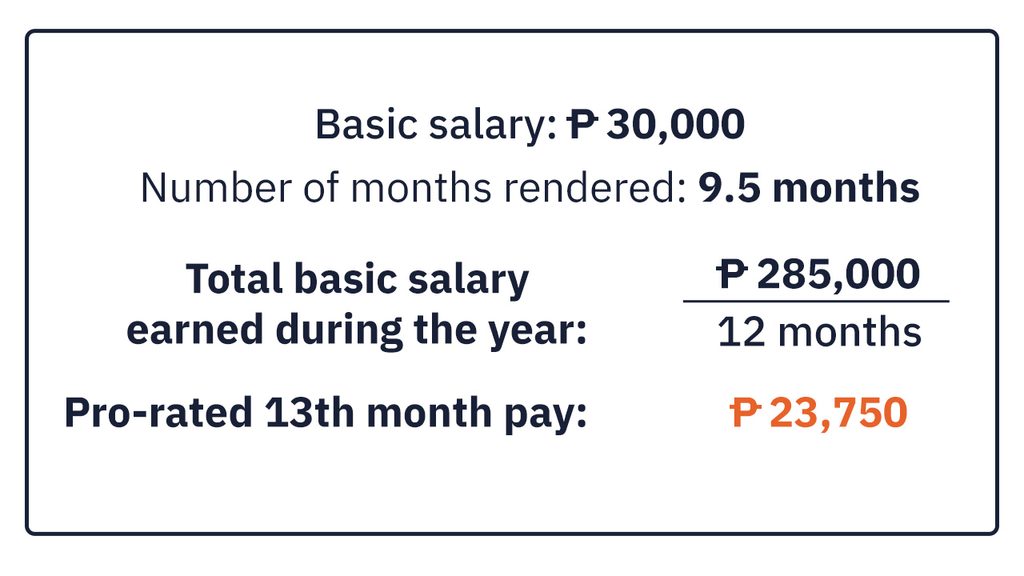

The computation for the 13th month pay follows this formula: 13th month pay = total basic salary earned during the year divided by 12 months.

Let’s put some numbers to it.

Let’s say you started working by March 15 with a basic salary of P30,000 monthly. To compute your 13th month pay, multiply your basic salary by the number of months you have worked for the year to get your total basic salary. For this example, P30,000 multiplied by 9.5 months is equal to P285,000.

Now, divide your P285,000 total basic salary by 12 months. Your 13th month pay will be P23,750.

When does it become taxable?

Generally, the 13th month pay, along with other benefits such as Christmas bonus and other productivity bonuses, is tax-free. It only becomes taxable when the gross amount of benefits received for the year exceeds the P90,000 tax exemption threshold, as provided by the Philippine tax code.

When the gross benefits exceed the tax-free threshold, the benefits will be subject to tax in accordance with the income tax bracket that the net income falls under. An employee whose gross benefits exceed the tax-free threshold will still receive the benefit in full, and the tax on the excess amount will be reflected on the income tax deducted from his or her salary.

Let’s again put some numbers to it.

If, for example, you have a P100,000 monthly basic salary and provided you have been working since January, you will receive your 13th month in full. The tax on the excess P10,000 will be applied to your net taxable income. How to compute for that? Read the story below.

Have you received your 13th month pay yet? Remember, the law requires it to be released before December 24. – Rappler.com

Add a comment

How does this make you feel?

![[Ask the Tax Whiz] How to compute income tax under the new income tax table for 2023?](https://www.rappler.com/tachyon/2021/06/shutterstock-bills-taxes-calculator-ls.jpg?fit=449%2C449)

There are no comments yet. Add your comment to start the conversation.