SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

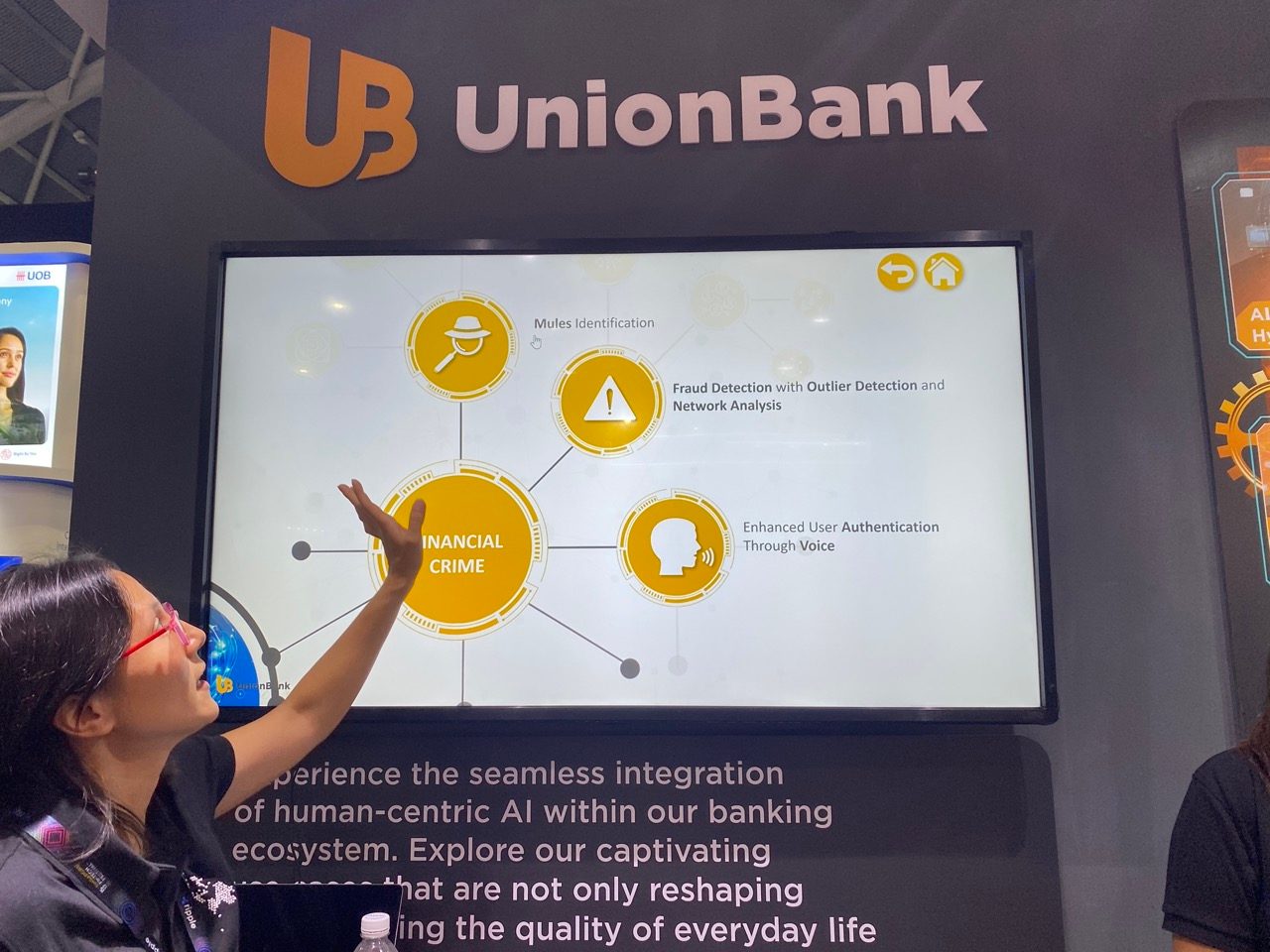

SINGAPORE – To fight financial fraud, Union Bank of the Philippines (UnionBank) is developing its own set of artificial intelligence solutions ranging from voice authentication that could replace one-time passwords (OTPs) to models that identify money mules and fraud patterns.

In the Philippines, scams and online fraud have already cost Filipinos at least P155.20 million in the first eight months of 2023 alone. A TransUnion survey of 907 adult Filipinos also showed that 64% of respondents reported being targeted by fraudsters.

While customers have a responsibility to keep their accounts safe, banks are also beginning to upgrade their cybersecurity measures to keep pace with tech-savvy scammers.

For its part, Aboitiz-led UnionBank unveiled a set of artificial intelligence tools in development that could quickly identify criminal activity by scammers, fraudsters, and money mules.

AI-powered voice authentication

On the sidelines of the Singapore FinTech Festival, UnionBank said it has completed the proof of concept for the use of voice authentication in its customer service calls.

“When they call now, instead of having to answer, what’s your OTP, what’s your security question, they will just speak about their concern. This is running in the background, and we’ll automatically authenticate them,” said Adrienne Heinrich, head of Aboitiz Data Innovation’s Artificial Intelligence and Innovation Center of Excellence.

UnionBank promises that the technology will provide “enhanced user authentication through voice” and make the customer service process “as frictionless as possible.”

In terms of user authentication, Heinrich said that iris scans are at the top, but the technology is expensive and cumbersome. Face recognition has also gained popularity – particularly on smartphones and tablets – but Heinrich also highlighted cases where children are able to unlock their parents’ phones because they share similar facial features.

Voice authentication stands as a strong alternative. Right now, the system is already able to account for noisy environments, different dialects, and changes in a customer’s voice due to sickness because the AI is able to learn a customer’s voice every time that they interact with the bank.

“We have incorporated [these] in our data collection for the proof of concept, and we were able to perform well even in the presence of these challenging conditions,” Heinrich told Rappler.

Once the technology advances to a stage where it’s highly reliable, it could replace the need for an OTP altogether during customer service calls. And if all goes well, it could be rolled out across the rest of the bank’s system too.

“Ideally, when the matching score is very high, it will be a much easier process for the customer. So then you can think of [OTP] being replaced if it will work out very well,” Heinrich said on November 15.

Detecting fraud patterns

Aside from voice authentication, UnionBank is also using AI models for fraud detection through outlier detection and network analysis.

Outlier detection is the more traditional method of flagging suspicious transactions. It establishes a user’s normal pattern of transaction behavior. When the AI detects and flags anomalous transaction behavior that deviates from the usual pattern, human investigators can then take over.

“With outlier detection, you have a normal pattern of transactions. When you detect that there are outliers, you can signal them out. That’s how you can identify potential fraud cases. This is the traditional way,” Heinrich said.

Aside from this, UnionBank is also using network analysis to detect fraudulent relationships between account holders, allowing the bank to pinpoint potential fraudsters even if that particular bank account itself doesn’t have any red flags. That works by seeing how accounts connect to each other through transactions.

“Everyone speaks of hyperpersonalization, or making product offerings to an individual. Here, you want to do the opposite: you want to understand the group’s behavior and who is involved in this group,” Heinrich told Rappler on Thursday, November 23.

“It can be that an account’s transactions do not raise any red flags at all…. [But] we need to investigate also the initially non-suspicious account [if] it seems connected to the group of suspicious accounts,” Heinrich explained.

Network analysis could show, for example, how a non-suspicious account is actually linked to multiple other suspicious accounts through transactions over multiple degrees. Analyzing the evolution within the network, or how an account relates to other accounts over time, would also allow the bank to identify fraudulent parties earlier.

Identifying mules

The Aboitiz-led bank has also leaned on AI in its fight against money mules. These are persons who, knowingly or unknowingly, move illegally acquired money. Money launderers often use money mules to help obscure the money trail of their criminal activities.

The Anti-Money Laundering Council (AMLC) noted that the number of money mules and suspicious transactions related to them have soared since 2021, with the year-on-year increase of money mule-related suspicious transactions peaking at 1,277% in 2021.

“Most of the time, they’re not aware that they are money mules. This is very prevalent in the Philippines. That’s why we created this AI model to help catch those mule accounts,” Ana Jania Mañalac, senior vice president of data science and AI group at UnionBank, said.

Using AI, UnionBank is now able to automatically detect and predict which bank accounts are at high risk of being mules. That enables proactive investigation of mules, rather than relying on a reactive approach of investigating only when a customer complains of unknown transactions involving their account.

“With this solution, we actually have an efficiency gain of more than 10 times. Because before, we used to detect accounts more than a month after when a customer complains. But now, just a few days after their account opens, we can already detect which ones are mules,” Mañalac said.

This isn’t the first time that UnionBank has turned to AI for similar purposes. In August 2022, the lender began using AI to streamline its anti-money laundering measures.

“The Anti-Money Laundering Council of the Philippines actually requires that all suspicious transactions be investigated and monitored. But given the parameters of AMLC, thousands of alerts go to the branches for investigation,” said Heinrich.

“That was taking a toll on the branch manpower. So we created an AI solution,” she added.

Using its anti-money laundering alert resolution data, UnionBank combined data science, artificial intelligence, and cloud platforms to create its “Suspicious Transaction Report Alerts Prioritization and Auto-Disposition Model.”

The model can predict which customers are at high risk of being involved in money laundering. Only when these transactions are flagged do staff at the branch conduct a manual investigation.

With the model in operation, the bank reduced the number of alerts that were in need of investigation by 40%, freeing up branch manpower and earning the bank recognition at the Asian Technology Excellence Awards. – Rappler.com

Disclosure: The author was part of a media delegation to the Singapore FinTech Festival 2023 sponsored by UnionBank, an exhibitor in one of the festival’s 16 international pavilions.

Add a comment

How does this make you feel?

![[Finterest] Is a digital bank safe, and how can you best use it?](https://www.rappler.com/tachyon/2024/05/digital-banks-safety-may-11-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.