SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

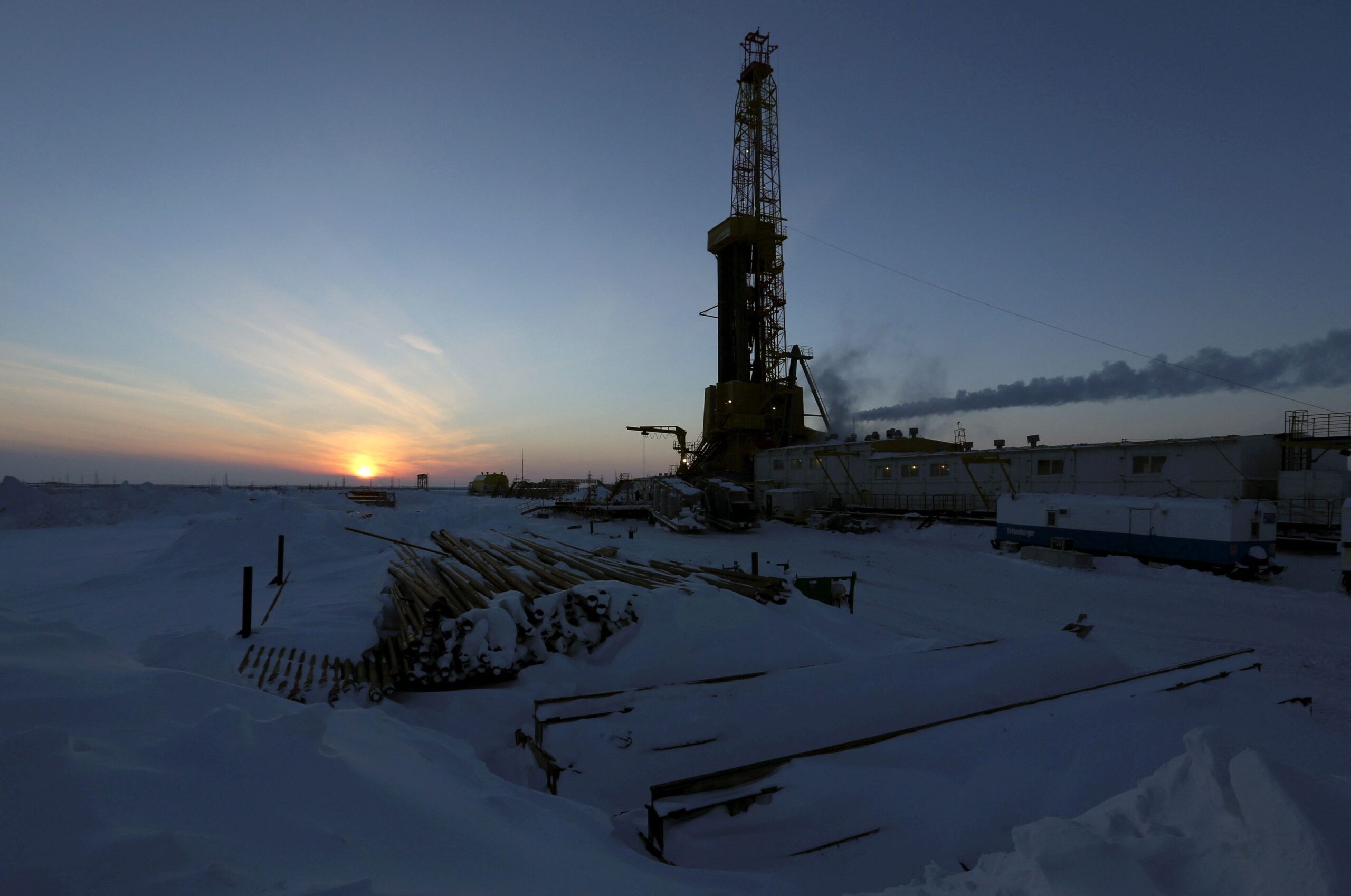

LONDON, United Kingdom – Russian oil trade was in disarray on Tuesday, March 1, as producers postponed sales, importers rejected Russian ships, and buyers worldwide searched elsewhere for needed crude after a raft of sanctions imposed on Moscow over the war in Ukraine.

Numerous nations imposed sweeping sanctions against Russian companies, banks, and individuals following Russia’s invasion of Ukraine last week and global majors announced plans to leave multimillion-dollar positions in Russia.

US, European, and other governments exempted energy trade from sanctions to prevent already tight markets rallying further, but that has failed.

Global benchmark Brent crude settled at nearly $105 a barrel on Tuesday, its highest since August 2014, as refiners, traders, and oil majors steer clear of Russia, out of an abundance of caution that they may unwittingly run afoul of sanctions somewhere.

Russia is the second largest exporter of crude worldwide, trailing only Saudi Arabia, as it ships out 4 million to 5 million barrels per day of crude, along with 2 million to 3 million bpd of refined products. With demand already surging past pre-pandemic levels and major producers struggling to keep up, market players are increasingly fearful that prices will keep rising.

The knock-on effects of sanctions were felt all across the oil market on Tuesday. Russia’s key Urals oil grade was bid at a discount of more than $18 below physical Brent crude, the primary worldwide benchmark, a record in the post-Soviet era. Even at that price, traders have been unable to find willing buyers.

“Nobody wants to buy, ship, or store Russian oil,” a trader of Russian oil said.

In response to the severity of the disruption, the International Energy Agency (IEA) said it would coordinate a release of 60 million barrels of oil reserves from big consumers, with half coming from the United States.

The market responded by rallying even more, seeing the release – the equivalent to less than a day’s worldwide oil consumption – as underscoring the worldwide supply crunch.

Traders in futures markets aggressively pushed the price of current Brent contracts to more than $15 higher than contracts that will deliver oil six months from now. That was also a record, and indicative of growing worries about tight supply.

Shunning Russian barrels

Even non-Russian oil has been snagged in the turmoil.

Five traders who spoke with Reuters said buyers were avoiding oil delivered by the CPC pipeline – which delivers more than 1 million bpd from Kazakhstan, or over 1% of world supply – because it can mix with Russian grades and terminates at a Russian port on the Black Sea, traders said.

“It’s an important source of supply – over a million barrels a day – into a world which right now really needs that oil supply,” Chevron chief executive Mike Wirth said in a Tuesday call with reporters.

Chevron Corporation has a 15% stake in CPC and a 50% stake in Tengizchevroil (TCO), which is developing crude oil fields in western Kazakhstan.

Rival energy firms BP, Equinor, and Shell have abandoned multibillion-dollar positions in Russia, and BP has already canceled all of its fuel oil loadings from the Russian Black Sea port of Taman, sources familiar with the matter said.

Exxon Mobil said it was pulling US employees from Russia, even though it has not said it will give up operations there.

Buyers around the world were trying to secure supplies from elsewhere. State-run Indian refiner Bharat Petroleum Corporation, which buys roughly 2 million barrels of Russian Urals monthly, is seeking more oil from Middle Eastern producers for April.

Canada said on Monday, February 28, it would ban oil imports from Russia.

US traders have started shunning Russian barrels, while Asian buyers were awaiting clarity from banks on whether they can transact with Russian sellers.

The Malaysian government said a Russian-flagged oil tanker targeted by US sanctions will not be allowed to call at Kuala Linggi port.

European Union countries are considering a ban on Russian ships entering ports in the bloc. Britain said on Monday it would deny entry to British ports to all ships that are Russian owned, operated, controlled, chartered, registered, or flagged.

Russian solutions

Russia, meanwhile, is expected to boost supplies to China. Oil pipeline monopoly Transneft, which handles more than 80% of total oil produced in Russia, plans to increase supplies to China via the ESPO pipeline this month to 2.48 million tons from 2.22 million tons in February, according to TASS news agency.

Some Russian oil companies have stopped banking with sanctioned lenders, including VTB and Sberbank, and switched to those that do not face restrictions, including Rosbank, Unicredit, and Raiffeisen, five people familiar with the matter told Reuters. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.