SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The seed capital of the proposed Maharlika Wealth Fund (MWF) is expected to decrease by more than half compared to past proposals, as the Bangko Sentral ng Pilipinas (BSP) may not be able to fill the P175-billion void left behind by removal of pension funds Social Security System (SSS) and Government Service Insurance System (GSIS).

During the House appropriations panel hearing on Friday, December 9, lawmakers introduced more amendments to the controversial legislation, including the suggestion to change the chairperson of the MWF Corporation (MWFC) board from the country’s president to the secretary of finance.

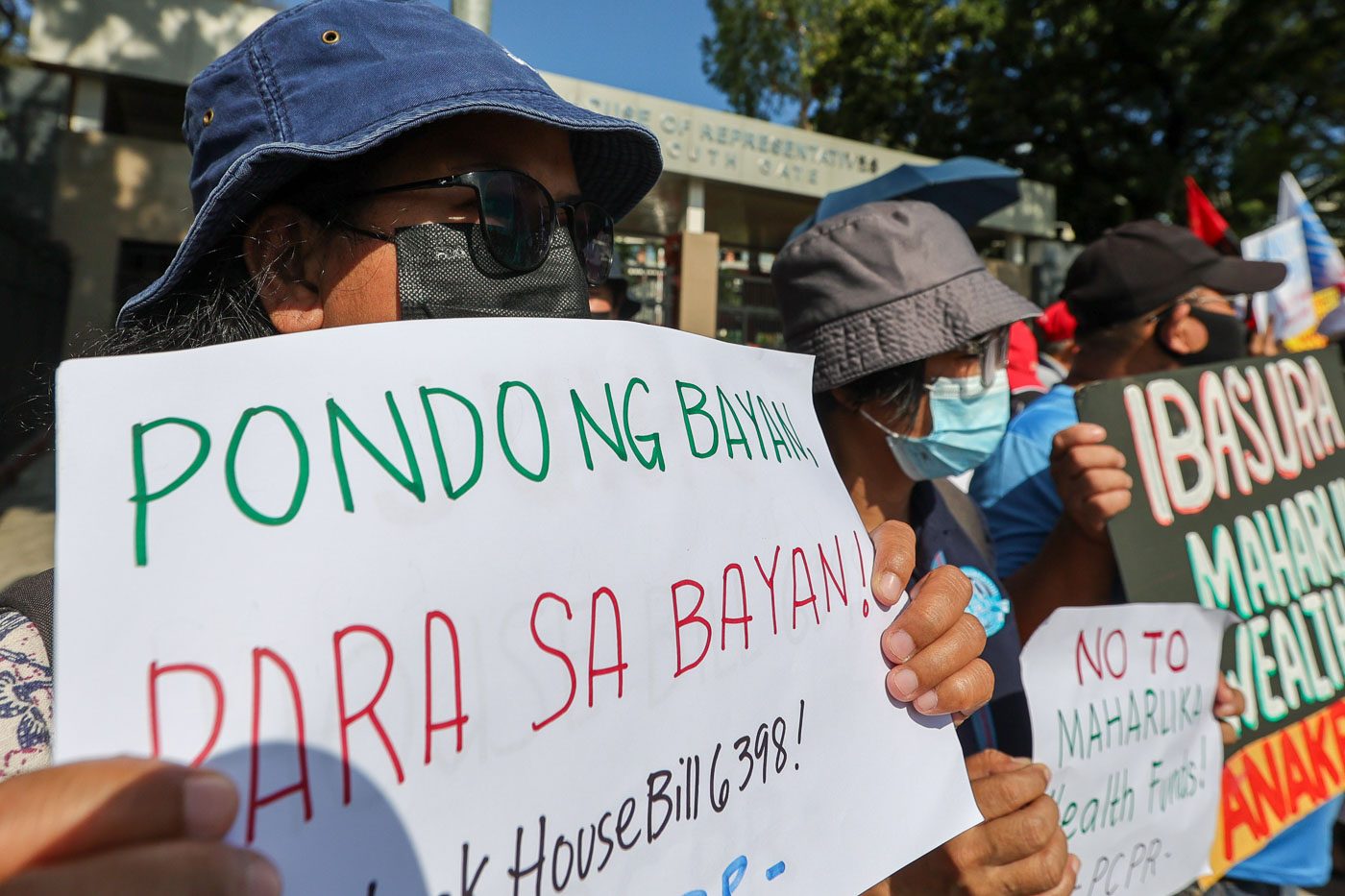

The hearing came two days after congressional leaders caved in to critics’ demand that the government take its hands off pension funds amid concerns that they would be lost to bad investments.

BSP dividends

The BSP said it was willing to pitch in 100% of its clear dividends to get the ball rolling for the proposed sovereign wealth fund.

Asked how much that would be, the central bank estimated that this was around P30 billion to P35 billion for the current year.

If that amount is added to the P75 billion that will be jointly contributed by the Development Bank of the Philippines (DBP) and Land Bank of the Philippines, the seed capital would only amount to P105 billion to P110 billion.

In a past proposal that factored in the GSIS and SSS, the initial capital of MWF was pegged at P275 billion, including the P25 billion from the General Appropriations Act (GAA) or national budget. That amount from the GAA was also removed in the latest iteration of the MWF bill.

“Congress may consider a formula allowing 100% of BSP’s declared dividends that is intended for BSP’s capital buildup to be used instead to fund the Maharlika Wealth Fund,” BSP Deputy Governor Francisco Dakila Jr. said.

“Congress may thereafter consider a 50-50 sharing between BSP’s capitalization and funding source for the MWF until such time the BSP is fully capitalized. After full capitalization, the declared dividends of BSP to the national government may be earmarked wholly to fund the MWF,” he added.

Two days before the amount of contribution was disclosed, House vice appropriations panel chairperson Stella Quimbo said that the funding from BSP was “sufficiently large to start an investment fund of this nature.”

Quimbo on Friday made a motion taking into consideration the BSP’s word, and the panel subsequently adopted the amendment proposed. (READ: PCCI, major business groups: Not the right time for Maharlika fund)

New chair

The House panel also carried Quimbo’s motion to amend a provision that said the Philippine president would chair the board of the MWFC.

The latest proposed 15-member board composition is as follows:

- finance secretary (chairperson);

- chief executive officer of the MWFC;

- president of the Land Bank of the Philippines;

- president of the DBP;

- seven regular members representing the contributors of the fund; and

- four independent directors from the private sector.

“It’s a no-win situation for the president to chair such a board. If the fund makes a lot of money, people will always politicize and say, ‘It made a lot of money, and the politicians are probably making something out of that.’ If it loses money, they are going to blame the president and the politicians,'” said House Senior Deputy Majority Leader Paul Daza.

The Maharlika Wealth Fund bill is expected to be elevated next week to the House plenary, where opposition lawmakers will have the opportunity to interpellate sponsors of the measure.

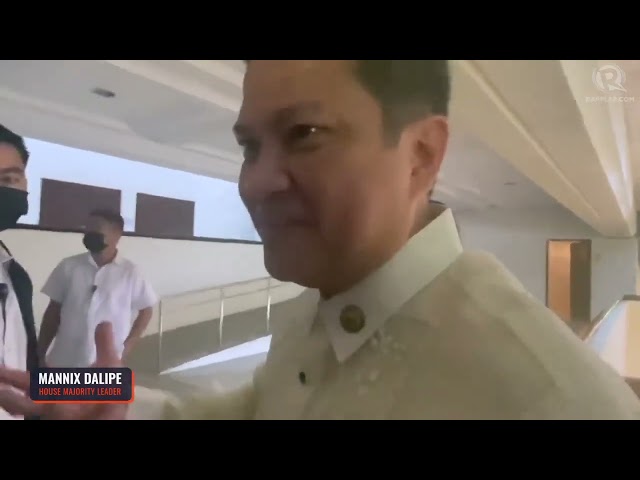

House Majority Leader Mannix Dalipe has said he estimated the bill to be approved on second reading before Congress goes on a holiday break on December 17.

– Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] On the Maharlika Wealth Fund](https://www.rappler.com/tachyon/2022/12/tl-maharlika-fund-justice-carpio.jpg?fit=449%2C449)

![[In This Economy] Why Marcos is getting high on unprogrammed funds](https://www.rappler.com/tachyon/2024/07/TL-marcos-program-funds-july-19-2024.jpg?resize=257%2C257&crop=265px%2C0px%2C720px%2C720px)

![[In This Economy] Is the Marcos government unlawfully dipping into PhilHealth funds?](https://www.rappler.com/tachyon/2024/07/marcos-government-philhealth-funds-july-12-2024.jpg?resize=257%2C257&crop=425px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.