SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

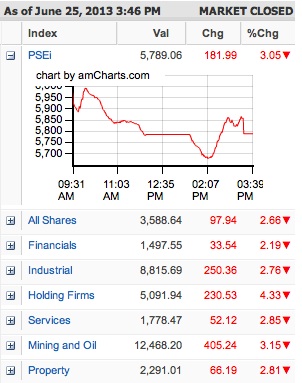

MANILA, Philippines (UPDATED) – The local stock market entered bear territory as the main index fell for the 5th straight day on Tuesday, June 25, wiping all the gains for 2013.

MANILA, Philippines (UPDATED) – The local stock market entered bear territory as the main index fell for the 5th straight day on Tuesday, June 25, wiping all the gains for 2013.

The benchmark Philippine Stock Exchange index (PSEi) settled at 5,789.06, down 181.99 points or 3.05% from previous day’s close of 5,971.05.

The PSEi stood at 5,860.99 on the first trading day of the year. It has declined by 25.7% from its record-high close of 7,392.20 on May 15.

“By definition, if you fall 20% from your record high, that’s bear market,” said Joseph Roxas, president of Eagle Equities.

However, Roxas noted “bear is relative.”

“Bear can turn into bull in a matter of days. There might be a rally in the coming sessions that will buoy the market above the 6,000 level again,” he explained, adding that investors were expected to hunt for bargains.

The broader all-share index went down 97.94 points or 2.66% to 3,588.64.

All counters were in negative territory, led by the mining and oil index, which lost 3.15%.

Losers outnumbered gainers, 168 to 29, while 18 stocks were unchanged.

A total of 5.18 billion shares worth P12.97 billion were traded.

Global markets continued to post losses after the US Federal Reserve’s June 19 announcement that it might start rowing back on its multi-billion-dollar stimulus scheme.

While the move shows the US economy is gaining strength, dealers fear it means there will be less cash in the financial system to invest.

Philippine officials stressed that the fundamental strengths of the local economy remained healthy. The country grew a stellar 7.8% in the first quarter, one of the fastest in the world.

“We realize that some investors are losing money and we sympathize with them. I believe once this indiscriminate global sell off is done, there will be a flight to quality emerging market assets and we will benefit from this,” Presidential Communications Secretary said in a Malacañang press briefing on Tuesday. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.