SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – President Ferdinand Marcos Jr., who took on the role as concurrent agriculture chief to emphasize the importance of uplifting the sector, is now confronted with the politics and economics of the sugar industry.

Competing soda makers have issued a rare statement confirming a shortage of premium refined sugar. Seasoned and career agriculture officials have resigned over an importation row. Farmers have been pushing back over import proposals and are lamenting the dismal state of the industry. Lawmakers are firm on pursuing a congressional probe into the sugar importation mess.

Developments in the sugar imports saga just keep getting bitter.

Sugar crash

Large-scale farming of sugarcane in the Philippines began in the 1700s, when the country was still a Spanish colony, and flourished in the mid-1800s with plantations expanding from Luzon to the Visayas.

In the 1900s, during the American colonial period, sugar from the Philippines was exported to the United States. The Philippines continued to export to the US through its preferential access even after it gained independence. The country historically exported over half of its sugar to the US.

Low farm productivity and increased domestic demand led to a decline in sugar exports. Sugar prices have also been high due to Philippine protectionist policies with little improvement in farming methods.

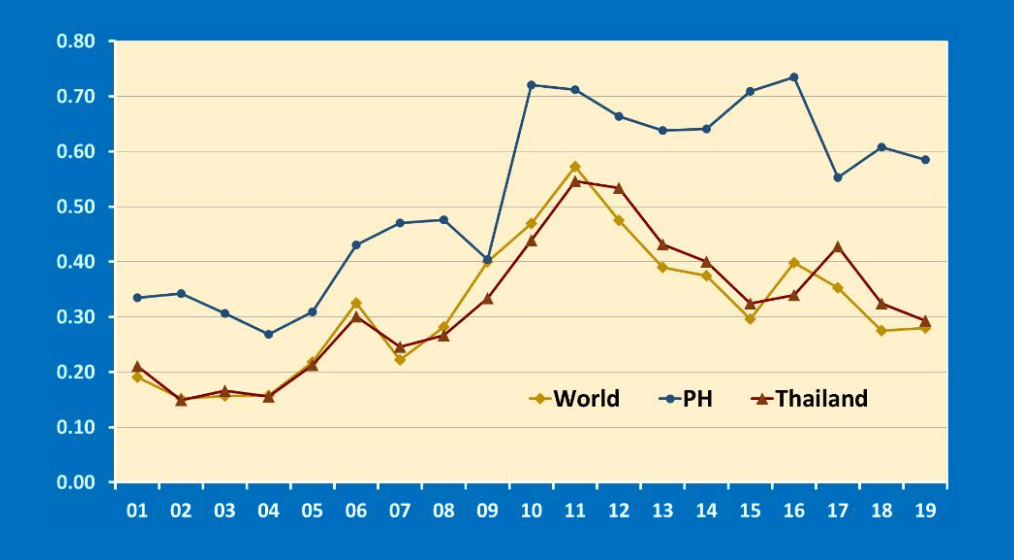

According to “An Assessment of Reform Directions for the Philippine Sugar Industry,” a discussion paper of the National Economic and Development Authority (NEDA) published in 2021, Philippine sugar prices were twice the world price and Thai export prices in 2019.

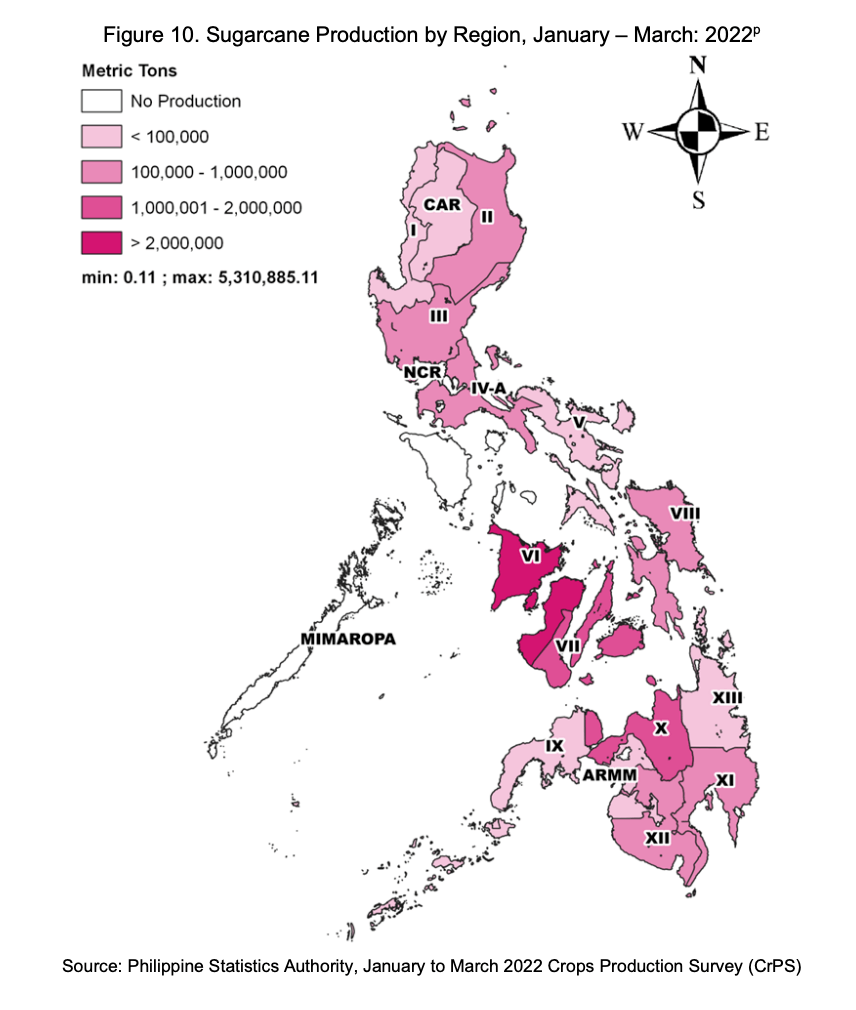

According to a Philippine Competition Commission (PCC) paper published in 2020, there are only 27 sugar mills throughout the country as of March 2020. In most regions, only one or two mills are in operation to serve all of their planters.

The PCC said that the reason for the low number of mills is the large fixed investment outlay – at least P2 billion for a new factory – which requires a large production scale to remain economical.

According to the Sugar Regulatory Administration (SRA), local sugar production will hit just 1.8 million metric tons in 2022, short of the annual demand of 2.03 million metric tons observed in the past three years.

Still important

While the sugar industry has fallen from its peak, it still remains to be a critical component in the economy.

NEDA estimated that sugar farms continue to employ half a million workers. The industry also spans an aggregate area of 410,000 – larger than the aggregate area 25 years ago – and contributes P86 billion to the economy.

Total production of sugarcane reached $815 million in 2020, making it the fifth largest crop by value, after rice, bananas, corn, and coconuts. But in terms of share in the agricultural gross domestic product, it fell to 1.9% in 2018 from a peak of 3.6% in 1999.

NEDA added that the industry is finding new business opportunities in alternative products like bioethanol, muscovado, and biomass-based electric power.

Why the sugar industry is struggling

NEDA cited the following as among the top issues besetting the sugar industry:

- Fragmented land ownership

- Lack of improved cane varieties

- Poor soil quality

- Inadequate irrigation

- Labor shortages

- Low farm mechanization

- Inadequate financial capital

Economists also attribute the decline to the insulation of the industry from the international market.

Republic Act No. 8178 or the Agricultural Tariffication Act eliminated quantitative restrictions (QRs) on the importation of agricultural products, replacing them with more transparent import tariffs. But in reality, sugar importation is tightly controlled by the SRA.

Executive Order No. 18 empowers the SRA to regulate the quedan system, which allows it to segment the use of raw sugar into specific uses: exports to the US, domestic market, reserves, and world exports.

The SRA typically allots 5% to 10% of total sugar output to the US market every year. In years where supply is tight, allocation is almost zero. The SRA also heavily regulates and restricts sugar shipping among the Philippine islands.

A mandatory sharing arrangement between sugar mills and sugarcane planters is also in place, ranging from 60% to 40%, to 70% to 30%, planters’ and mills’ share, respectively.

In a nutshell, while the government has shielded the local sugar industry, production has not improved and prices have not become competitive.

The liberal route

With soaring sugar prices and supply constraints, is it time for Marcos to open the market to more imports and liberalize the sugar industry?

“Ayaw na ayaw natin mag-import hangga’t maaari. Ngunit ang problema, hindi sapat ‘yung production natin. At kung minsan ‘yung presyo pati ay napakataas. Kaya’t kailangan natin,” Marcos said in a news briefing on Wednesday, August 17.

(As much as possible, we really don’t want to import [sugar]. The problem is, production is not enough. Sometimes, prices are very high. So we need to import.)

He added that he will reorganize the SRA, although he did not detail how.

“We’ll reorganize the SRA and then we will come to an arrangement with the industrial consumers, with the planters, the millers, suppliers of the sugar to coordinate para talaga kung ano ‘yung mayroon, kung ano ‘yung available, mailabas na sa merkado. And ‘yung kulang, eh kunin na natin, kunin na natin. Mag-import na tayo. Mapipilitan talaga tayo,” Marcos said.

(We’ll reorganize the SRA and then we will come to an arrangement with the industrial consumers, with the planters, the millers, suppliers of the sugar to coordinate to determine the supply and release what’s available to the market. For the shortfall, we will have to import. We will really be forced to do so.)

In a forum organized by the Economic Journalists Association of the Philippines, Central Bank Governor Felipe Medalla said that laws that govern the sugar industry need to be reviewed, adding that the matter is not a “technocratic issue,” but a “political” one. (READ: Malacañang probes ‘illegal’ sugar importation resolution)

NEDA’s discussion paper noted that while liberalization would benefit consumers, it would favor the rich more than the poor.

“All this would be at a clear cost to the sugar industry stakeholders. While industrial users of sugar would benefit, the impact on them appears relatively modest,” the paper said.

The case for sugar trade liberalization appears weak at this time. Should it be pursued nonetheless, it would best be done gradually and only partially, especially in the face of severe distortions in the world sugar market. – NEDA

NEDA simulations also indicate that fully liberalizing the sugar trade would predictably hurt planters and millers, whose profits are projected to dip by 57%, while consumers gain in welfare by up to 65%.

Declining prices of up to 11% would be felt, but employment in the sugar manufacturing industry would go down by as much as 16%, while domestic output would go down by 6.8%.

The PCC for its part, recommended the liberalization of raw and refined sugar imports.

“The closure of the domestic market to competition from foreign suppliers is a key factor behind the vulnerability of the domestic industry to competition failures,” PCC said. – with reports from Bea Cupin/Rappler.com

Add a comment

How does this make you feel?

![[Vantage Point] Sugar mess gets messier (Part 2)](https://www.rappler.com/tachyon/2023/04/Sugar-mess-April-1-2023-f.jpg?resize=257%2C257&crop=304px%2C0px%2C720px%2C720px)

![[Vantage Point] Sugar mess gets messier](https://www.rappler.com/tachyon/2023/03/sugar-smuggling-march-21-2023.jpg?resize=257%2C257&crop=378px%2C0px%2C1080px%2C1080px)

![[Just Saying] SONA 2024: Some disturbing points](https://www.rappler.com/tachyon/2024/07/TL-marcos-sona-points-july-23-2024.jpg?resize=257%2C257&crop=335px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.