SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippines will borrow another $300 million – around P17 billion – from the Asian Development Bank (ADB) to aid the government in “creating a stronger institutional and policy environment” for more Filipinos to access financial services.

The new loan is part of the ADB’s Inclusive Finance Development Program, Subprogram 3, which is supposed to help expand financial inclusion in the Philippines.

This is not the first time that the Philippines has taken an ADB loan in pursuit of financial inclusion. The Philippines has borrowed $300 million twice from the ADB in the past – once in October 2018 and again in August 2020 as part of the multilateral lender’s Subprogram 1 and Subprogram 2.

The billions of pesos loaned under Subprogram 1 were used to develop the national ID system, promote agriculture value-chain financing products and microinsurance policies, boost digital payment infrastructure, and support microfinance and rural financial institutions.

Meanwhile, one of the projects under Subprogram 2 was the introduction of a national QR code standard for digital payments.

Where will the money go this time? It will be channeled towards policies and reforms that, according to ADB senior financial sector specialist Kelly Hattel, will allow the government to provide assistance faster during emergencies, expand insurance for the climate resilience of farmers and small businesses, and promote improved financial stability.

The ADB also said the loan will go towards supporting rural banks and non-bank financial institutions, and improving the country’s “digital financing ecosystem”.

As of end-August, the Philippines’ total outstanding debt has reached P14.35 trillion.

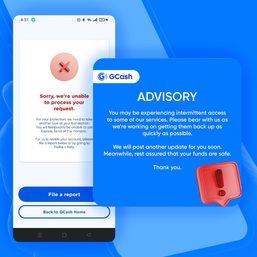

The Bangko Sentral ng Pilipinas (BSP) has also been vocal about promoting financial inclusion – even if it sometimes means taking on more debt. BSP Governor Eli Remolona believes developing digital payments can serve as the “gateway to financial inclusion” since online platforms like mobile wallets can help bring Filipinos into the financial system. (READ: Bangko Sentral hopes to ‘shame’ banks into removing fees on small transfers)

The government has the ambitious goal of bringing the number of Filipinos with a financial or mobile money account to 70% by 2024 and 90% by 2028 from 29% in 2019 (baseline year), according to BSP reports. One way that it plans to make the process of setting up an account easier is through the Philippine Identification System, or the country’s national ID.

As of September 1, 2023, around 88% of the population have already been registered under the national ID program. However, not everyone registered under the system has received their ID, and several thousand identification cards were also destroyed in the Manila Central Post Office fire. – Rappler.com

($1 = P56.69)

Add a comment

How does this make you feel?

![[Vantage Point] How safe is our money in banks?](https://www.rappler.com/tachyon/2023/03/Banks-TL_March-28-2023.jpg?resize=257%2C257&crop=252px%2C0px%2C720px%2C720px)

![[Finterest] Is a digital bank safe, and how can you best use it?](https://www.rappler.com/tachyon/2024/05/digital-banks-safety-may-11-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.