SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

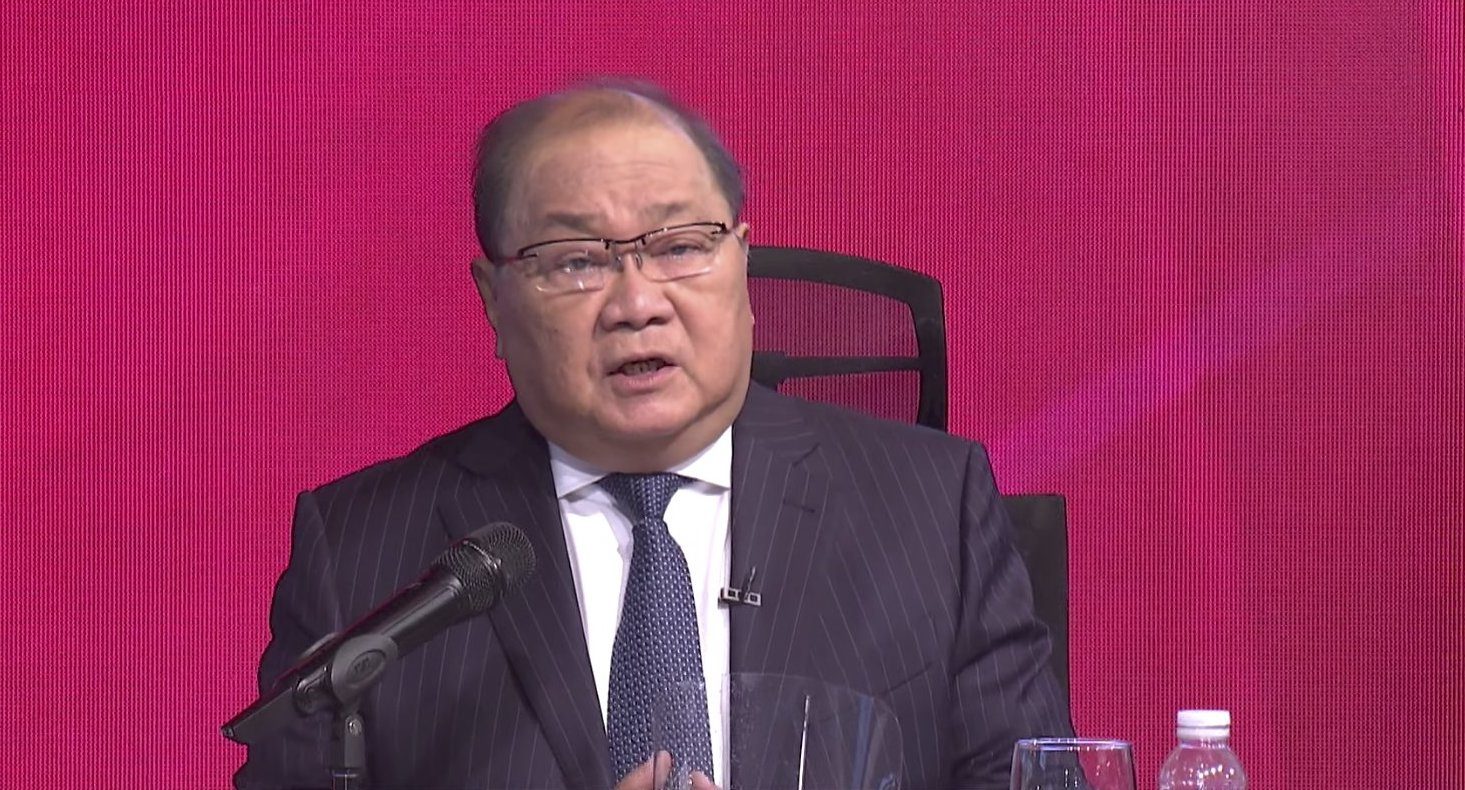

PLDT chairman Manny Pangilinan called the market capitalization of the telecommunications giant “undervalued” against peers.

At present, PLDT’s market capitalization is at around P350 billion, behind Globe Telecom’s P422 billion but still ahead of stock index newbie Converge ICT Solutions‘ P248 billion.

“That implies the [P100-billion] differential is how the market prices our enterprise and wireless business, together with a bit of international business,” said Pangilinan in a media briefing on Thursday, November 4.

For the first nine months of 2021, PLDT’s service revenues reached a record P135.9 billion, with its home segment growing fastest by 25% to P35.3 billion.

While two-thirds of service revenues consisted of individual and enterprise segments, the growth of these businesses inched up by 3% and 2%, respectively, for the first nine months. Quarter-on-quarter, the individual segment contracted by 3% while the enterprise business grew 2%.

The home segment, meanwhile, was driven mainly by the impressive growth in fiber, accelerating by 78% to P10.2 billion. PLDT is expecting to add at least 1 million fiber subscribers by the end of 2021.

Pangilinan said the market pricing of PLDT’s enterprise and wireless business at around P100 billion was on the “very low end of the scale.”

“It underprices our home [segment] whose revenues are almost twice of Converge,” Pangilinan said, adding that the subscriber base of the home segment is seen to widen in the coming months.

“I guess my remark focuses on how undervalued PLDT is in relation to our peer group, Converge and Globe, at least on the telco side,” Pangilinan said.

PLDT’s telco core income from January to September grew 10% year-on-year to P23.1 billion, on track to reach its full-year target set between P29 billion and P30 billion.

Quarter-on-quarter growth remained steady at P7.9 billion, inching up from the second quarter’s P7.7-billion core profit.

The growth was buoyed by lower tax rates, with PLDT benefiting from the Corporate Recovery and Tax Incentives for Enterprises Act which lowered corporate taxes from 30% to 25%.

Across business segments, data and broadband services maintained momentum, growing 14% to P103.9 billion, which is 76% of the total service revenues.

The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) margin is at 51% or P71.1 billion, an 8% improvement from 2020.

“The outlook, of course, is cautiously optimistic, but it is in an upward trend in terms of how the telco business will perform in the next three years. There will be no let-up in the EBITDA and core income in the next three years,” Pangilinan said.

As the economy reopens, the telco chairman said PLDT’s wireless business could benefit from that.

PayMaya’s road to unicorn status

PayMaya, a subsidiary of PLDT’s Voyager Innovations, is playing catch up with rival GCash, a unit of Globe Telecom’s Mynt, which recently achieved double unicorn status.

Pangilinan noted that PayMaya, during the last funding round, reached a $747-million valuation but in their sense, is worth “about a billion US dollars” right now.

“It is, of course, subject to market test, we probably achieved unicorn status as we speak. It’s not quite in the level of Globe but it’s in the billion US [dollars],” said Pangilinan.

He added that the adoption of Maya Bank, PayMaya’s digital bank set to launch in the first quarter of 2022, and PayMaya’s higher gross transaction value would give enough boost to the mobile wallet’s valuation.

“I don’t think the market yet appreciates the impact of the increasing value of PayMaya onto the share price of PLDT,” he said.

As of the end of September, PLDT said PayMaya has reached over 41 million registered users. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.