SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The story of how Ferdinand Marcos Jr.’s tax evasion was discovered began in 1990, four years into the presidency of Corazon Aquino. The Bureau of Internal Revenue (BIR) started a probe into the estate tax of Ferdinand Marcos who died in 1989, and also included unpaid taxes, if any, of his family and cronies. It was Jose Ong, then-BIR commissioner, who formed a Special Tax Audit Team just for this purpose.

The BIR team found that Marcos Jr. did not fulfill a basic duty. He failed to pay income taxes from 1982 to 1985 and neither did he file his income tax returns (ITR). At the time, Marcos Jr. was vice governor (1981-1983) and later governor of Ilocos Norte (1983-1986).

It took a while for the BIR to prepare its case. It was in July 1991 when Ong wrote the secretary of justice recommending that Marcos be charged criminally for failing to file his income tax returns and be ordered to pay the deficiency taxes. Silvestre Bello was then at the helm of the Department of Justice.

About a month later, in August 1991, the BIR served assessment notices to the San Juan, Metro Manila residence of the Marcoses, informing Marcos Jr. of his tax obligations. He was still in the US at the time where his family was forced into exile in February 1986.

The cases were then filed in court. Marcos Jr. returned to the country in October and, in December 1991, the trial of the consolidated cases began.

In his testimony, Marcos Jr. told the Quezon City Regional Trial Court (RTC) that he was surprised to learn of these cases because he thought that his staff took care of filing his ITRs. They did not remind him about these, he claimed. Moreover, he said that he did not receive any notice of assessment from the BIR before or after February 1986 up to the filing of the cases.

What the RTC said

Marcos Jr. basically put the blame on his staff. This did not sit well with the court. Judge Benedicto Ulep wrote in his pungent decision in 1995:

“The accused claims that he always thought that his staff prepared and filed his tax returns. Not only is such claim self-serving and uncorroborated by any of his former staff, it is also legally untenable. Besides, he admitted that he had no proof that he filed his income tax returns.”

After reviewing the testimonial and documentary evidence presented by the prosecution, Ulep found these “more than sufficient, if not overwhelming… to show that the accused failed to file his returns and pay his taxes…”

Ulep, in a stern tone, wrote:

“As Provincial Governor, the accused knew the importance of taxes. Without such, he could not have effectively administered the affairs of his local government unit. It follows then that he was well aware of the citizen’s duty, as it was also his, to file income tax return and pay the taxes due. Ignorance of such obligation to the State was no excuse. Yet, then Governor Marcos failed for four consecutive years to file his income tax returns and pay the taxes due…

It was not out of sheer ignorance or innocent neglect that he failed to do so. The length of time that he failed to do so indicates that his omission was willful, intentional and deliberate. Why not? Not only was he the Provincial Governor; he was the son of President Marcos. For him, it would have been short of lèse majesté to be charged with such crimes. These would have continued unnoticed had the Marcos regime not ended abruptly in 1986.”

The verdict? The court found him guilty of violating the Tax Code or the National Internal Revenue Code of 1977, sentenced him to seven years in prison and ordered him to pay fines.

After the verdict was read, Ulep ordered the arrest of Marcos Jr. who was not at the hearing. He was in London, according to an Associated Press report, although the RTC clerk was not aware of any court permission for Marcos Jr. to leave the country.

Scholarship fund?

There’s a side story here. That Ulep included it in his decision showed that it rankled the judge.

In his testimony, Marcos Jr. said that after receiving his first salary, he told the officer-in-charge of the provincial treasurer’s office to deposit all his salaries in a bank for a scholarship foundation for the poor. Upon his return from the US, he said he discovered that there was a withdrawal from his Philippine National Bank (PNB) account in Laoag – where all his salaries were deposited – in March 1986. He was still in Hawaii then and he claimed that he did not know who made the withdrawal. He did not authorize anyone to take out money from the bank.

At the time, the total deposit in his PNB account (from December 1982 to February 1986) was P351,347.76. Only one withdrawal was made, on March 3, 1986, in the amount of P350,000.

Two lies surfaced, as Ulep pointed out:

- There was no evidence by the defense that showed any withdrawal for any charitable or civic purpose: “In fact, not a single centavo was used for such purpose. As a consequence, the credibility of the accused and the credulity of his defense ring hollow.”

- As for the bank withdrawal, the court found it incredulous that this was done without Marcos Jr.’s written authorization. “Being a well-known personality, it was improbable that bank personnel would have approved the withdrawal despite the absence of the accused unless his required written authorization was presented. In this light, accused Marcos not only realized his salary income; he likewise benefited and made use of it.”

Court of Appeals conviction

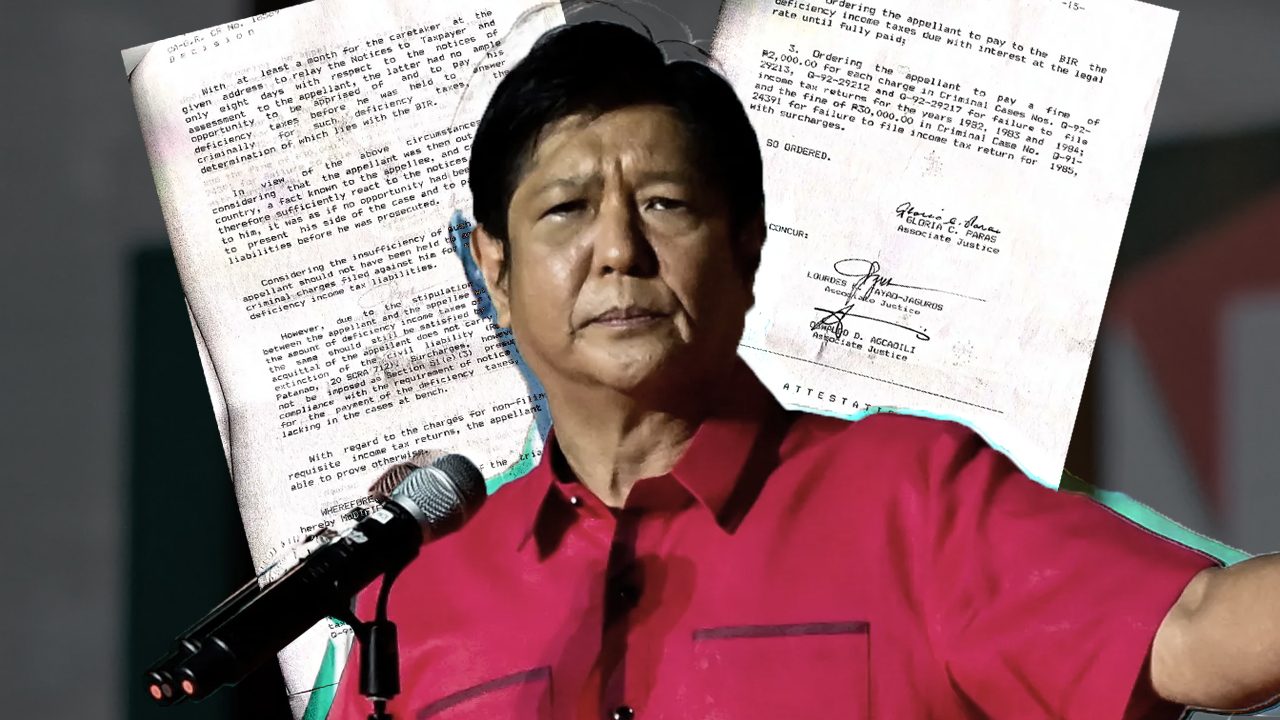

Marcos Jr. elevated his case to the Court of Appeals (CA), arguing that he was deprived of due process. The CA, in 1997, modified the trial court’s decision and took out the prison sentence.

The CA acquitted Marcos Jr. of failure to pay deficiency taxes. They said Marcos was not given due notice when the tax assessments were made.

But the CA found him guilty of failing to file ITRs. He was ordered to pay to the BIR the deficiency income taxes with interest and also pay the fine. In other words, the CA meted him a conviction.

But here’s where the contradiction sets in. As retired Supreme Court Justice Antonio Carpio pointed out in his Inquirer column: “Inexplicably, despite finding Marcos Jr. guilty of failure to file his income tax returns from 1982 to 1985, the CA imposed on Marcos Jr. only a fine without any imprisonment, despite the clear mandatory requirement of the Tax Code that the penalty shall be both a fine and imprisonment.”

The Supreme Court was Marcos Jr.’s next stop. However, for some reason, he withdrew his petition in 2001. The Court granted Marcos Jr.’s motion to withdraw since the solicitor general did not file his own appeal. Thus, the CA decision is the final word on this case.

Add a comment

How does this make you feel?

![[In This Economy] Marcos’ POGO ban is popular, but will it work?](https://www.rappler.com/tachyon/2024/07/thought-leaders-marcos-pogo-ban.jpg?resize=257%2C257&crop=255px%2C0px%2C720px%2C720px)

![[Rappler Investigates] POGOs no-go as Typhoon Carina exits](https://www.rappler.com/tachyon/2024/07/newsletter-graphics-carina-pogo.jpg?resize=257%2C257&crop=424px%2C0px%2C1080px%2C1080px)

![[OPINION] If it’s Tuesday it must be Belgium – travels make over the Marcos image](https://www.rappler.com/tachyon/2024/04/tl-travel-makeovers-marcos-image.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] There is a way to collect the P203-B Marcos estate tax debt](https://www.rappler.com/tachyon/2022/09/way-collect-203b-tax-marcos-september-13-2022.jpg?resize=257%2C257&crop=337px%2C0px%2C1080px%2C1080px)

![[Vantage Point] What will Marcos Jr.’s agenda be in his first SONA?](https://www.rappler.com/tachyon/2022/07/TL-Vantage-Point-Marcos-SONA-July-23-2022.jpg?resize=257%2C257&crop=336px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.