SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Vantage Point] NAIA rehab goes full throttle… finally!](https://www.rappler.com/tachyon/2023/09/NAIA-rehabilitation-full-throttle-September-2-2023.jpg)

By November 10, 2023, at the earliest or by the first quarter of 2024 at the latest, it is highly possible that the contract to rehabilitate the decrepit Ninoy Aquino International Airport (NAIA) would have been awarded to the winning bidder.

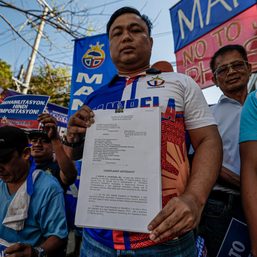

Rappler learned from highly-placed sources in the aviation sector that at least three investors have already bought the bid documents from the Department of Transportation (DOTr): San Miguel Corporation (SMC), the GMR Group of India, and the Manila International Airport Consortium (MIAC).

The SMC group is in the thick of building the New Manila International Airport, also known as the Bulacan International Airport. The GMR, in partnership with Megawide Corporation, is managing the Mactan Cebu International Airport. The MIAC is the same consortium which had earlier offered an unsolicited bid to rehabilitate NAIA. The MIAC includes units of listed conglomerates Aboitiz InfraCapital, Incorporated, AC Infrastructure Holdings Corporation, Asia’s Emerging Dragon Corporation, Alliance Global – Infracorp Development, Inc., Filinvest Development Corporation, JG Summit Infrastructure Holdings Corporation, and US-based Global Infrastructure Partners.

There are rumors, however, that the Aboitiz group would bid on its own and there could be other MIAC members thinking of going the same route. This may be due to the dissipation of the advantage of having a large group under the solicited-bid mode. A group of a maximum of three members makes more sense since each will have a sizable slice of the pie, rather than getting only 11% each under the MIAC umbrella.

The interested bidders paid P2.75-million each to purchase the non-refundable concession agreement and other documents to ensure their participation in the pre-bid conference set on September 22. The bid deadline is set on December 27.

The airport rehabilitation is one of the top priorities of the DOTr because the embarrassingly shabby NAIA is one of the reasons cited for the stunted growth of the Philippine economy, particularly the tourism sector. DOTr Secretary Jaime Bautista has been busy pitching the project to local and foreign investors with the confidence that the long-delayed airport overhaul would push through this time around.

During a recent forum in Tokyo, Bautista invited Japanese firms to take part in the bidding for the P170.6-billion NAIA upgrade project. “The concessionaire’s aeronautical revenues will consist of passenger service charges, landing and takeoff fees, aircraft parking, tacking, and cargo and others. The concessionaire will be allowed to conduct airport-related commercial activities within the project land,” he said.

Bautista and his team are working double time to make this project a success. They cannot afford to drop the ball. Their crafted rehab plan is technically and financially feasible, but the question that hangs like the Sword of Damocles over their head is: Will this latest iteration of the NAIA privatization program finally succeed, or will it tumble as previous attempts did?

The skeptics are not without a valid concern. They have witnessed a slew of failed attempts to spruce up NAIA dating back from the time it was first conceptualized during the term of President Fidel V. Ramos in the 1990s.

In 2018, then-president Rodrigo Duterte awarded an “original proponent status” to a NAIA “super consortium” composed of seven of the country’s biggest conglomerates. An original proponent status gives a company the right to counter-match any superior offers and win the project under a Swiss challenge. The super consortium proposed to invest P102 billion to upgrade the aging airport over 15 years. Even as the group was able to submit a revised proposal the following year, the project died a natural death in March 2020 over “unresolved issues” with the government.

In December 2020, a proposal from Megawide Construction Corp. and its partner GMR Infrastructure Ltd., (now known as GMR Airports Infrastructure Ltd. or GAIBV) was eventually rejected, with the government claiming that the group lacked the financial capacity to pursue the massive project. In September 2022, Megawide and GAIBV executed a Share Subscription and Transfer Agreement with Aboitiz InfraCapital, Incorporated (AIC), for AIC to acquire shares in GMR-Megawide Cebu Airport Corporation (GMCAC), the developer and operator of the award-winning Mactan Cebu International Airport (MCIA).

The DOTr received another unsolicited offer to upgrade the NAIA from yet another super consortium, participated in by five of the six conglomerates involved in an earlier failed bid. Included in its bid was a P57-billion upfront concession payment said to be the “largest ever” for a public–private partnership (PPP) project in the country’s transport sector. This proposal from MIAC was set aside in favor of the current bid terms that the government believes to be the more ideal route to take. Bautista is optimistic that the solicited mode would attract experienced and deep-pocketed private sector partners, given that air travel continues to recover after the devastating Covid-19 pandemic.

International roadshow

The DOTr has accepted the invitation of the Asian Development Bank’s Office of Markets Development and Public-Private Partnership (ADB-OMDP) – previously called the Office of Public-Private Partnership (OPPP) – for a combined market outreach study tour, including an international roadshow to Singapore and Europe. The OMDP is DOTr’s mandated transaction advisor for the rehabilitation, capacity optimization, and maintenance of the NAIA project which has obtained a statutory approval from the National Economic and Development Authority (NEDA) Board.

The roadshow will take place from September 13 to September 27, 2023.

Bautista expressed confidence that, with the passage of the Public Service Act (PSA), the NAIA project will attract many foreign investors. The PSA allows 100% foreign ownership in public services covered under the law’s implementing guidelines which were issued in March of this year.

I share Bautista’s optimism. Managing an airport is more profitable than managing an airline. Businesses in global aviation industry gravitate more on managing an airport than managing an airline. Managing an airline involves complexities, such as fuel price volatility, intense competition, labor costs, and fluctuating demand. Airlines often struggle to maintain consistent profitability, especially in highly competitive markets. Airports, on the other hand, generate revenue from a variety of sources, such as landing fees, terminal rentals, parking fees, concessions (restaurants, shops, rental cars), and real estate development on airport property. These diverse income streams can provide a stable revenue base.

I believe that the DOTr’s roadshow will attract multiple bids since the NAIA project remains a lucrative investment proposition for various local and foreign investors.

According to the transportation secretary, “The project is expected to improve overall passenger experience and increase the current annual passenger capacity of NAIA to at least 62 million from the current 32 million.”

The NAIA concession period will run for 15 years and, subject to certain conditions, can be extended by another 10 years. On top of the bid amount, bidders are required to make an upfront payment of P30 billion to MIAA and pay an annual fixed payment of P2 billion.

Each bidder, whether an individual or a consortium, must have a net worth of at least P25 billion, experienced in operating an international airport with at least 25 million passengers a year, and have personnel who are experts in running airports.

The document also placed limits on companies or entities that own or have “significant interest” in airports located within the greater capital region, namely, Clark International Airport (Pampanga), New Manila International Airport (Bulacan), and Sangley Point International Airport (Cavite).

Such companies also cannot own more than 20% interest in the NAIA consortium. Moreover, companies with interests in airlines cannot own more than 33% of the NAIA consortium.

Clark International Airport is being operated by JG Summit Holdings and Filinvest Development Corporation. The New Manila International Airport is being built by San Miguel Corp., while the Sangley Point Airport concession is led by the Virata and Yuchengco groups.

The comprehensive overhaul of our country’s international gateway is long overdue. The NAIA has been left to rot by the glaring inefficiency and half-hearted efforts of the airport’s previous administrations. It is this bitter lesson from the past that must be the driver propelling the present administration to make sure the NAIA is transformed from its decrepit state into a Philippine masterpiece of world-class modernity, economic self-reliance, and optimum passenger experience.

It’s about time.

Val A. Villanueva is a veteran business journalist. He was a former business editor of the Philippine Star and the Gokongwei-owned Manila Times. For comments, suggestions email him at mvala.v@gmail.com.

Add a comment

How does this make you feel?

![[Under 3 Minutes] When will we see modern jeepneys on the road?](https://www.rappler.com/tachyon/2024/04/francisco-motors-modern-jeepney-prototype-1.jpg?resize=257%2C257&crop=590px%2C0px%2C1012px%2C1012px)

![[Vantage Point] BDO lifts NAIA rehab](https://www.rappler.com/tachyon/2024/02/tl-naia-bdo-smc.jpg?resize=257%2C257&crop=370px%2C0px%2C1080px%2C1080px)

![[VANTAGE POINT] MIAA on the spotlight: Follies of the law](https://www.rappler.com/tachyon/2023/09/martires-miaa-september-5-2023.jpg?resize=257%2C257&crop=328px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.