SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

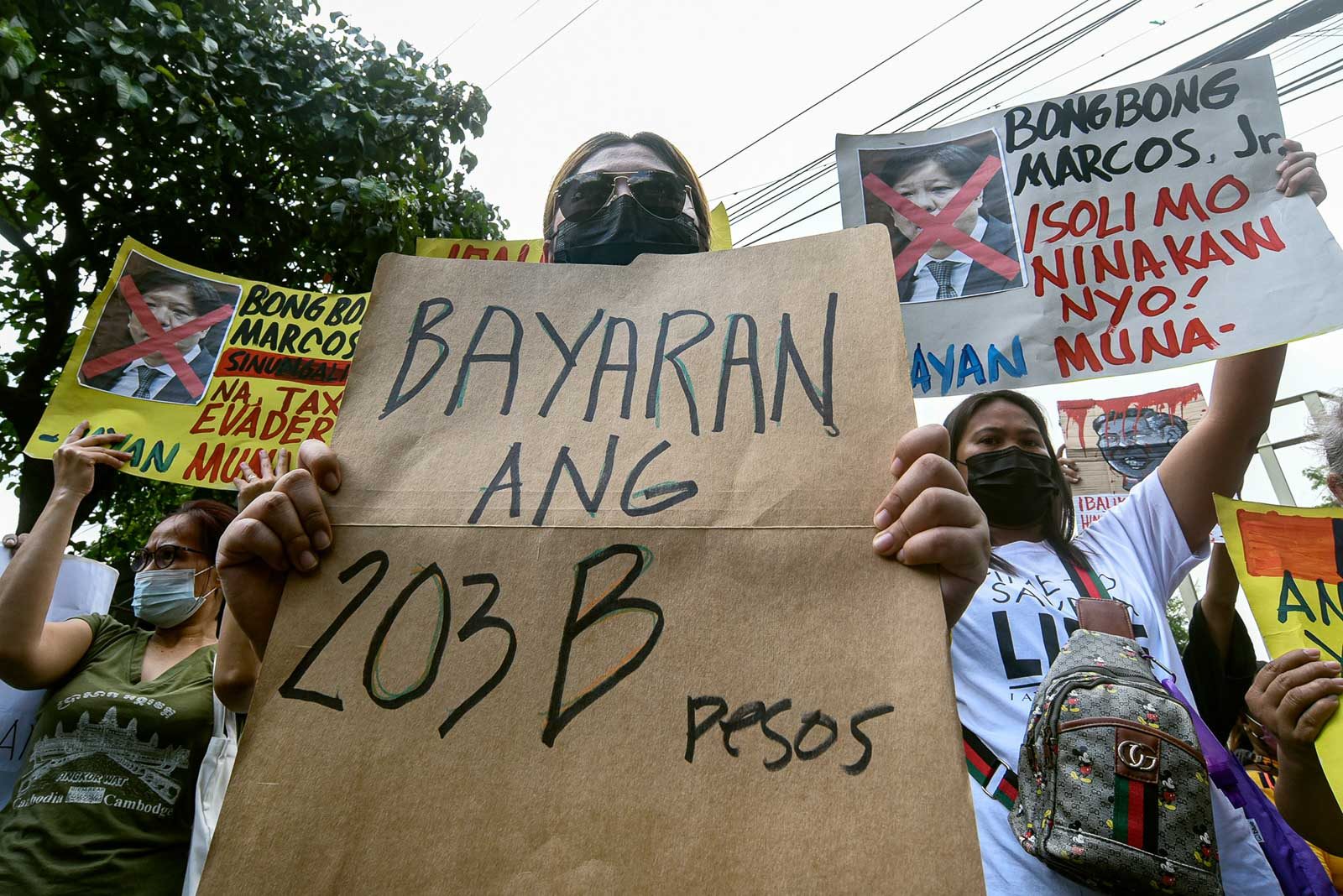

MANILA, Philippines – As Ferdinand “Bongbong” Marcos Jr evades questions on his family’s P203 billion estate tax debt, his supporters muddle the discussion by spreading false claims about Philippine tax laws if only to defend the non-payment.

Over the past days, Marcos’ supporters have amplified a comment from a political analyst that to charge the Marcos estate of tax would be to concede that it is not ill-gotten.

“That’s wrong logic, and a wrong understanding of the law. Because under the tax code, it doesn’t make a distinction whether the property is legally acquired or illegally acquired such as ill-gotten wealth. So as long as that property is yours at the time you die, pasok ‘yan sa gross estate mo at tatamaan ‘yan ng estate tax (that’s included in your gross estate and will be charged an estate tax),” said tax law expert Mickey Ingles over an episode of Law of Duterte Land Podcast.

When Ingles initially tweeted this comment, he was mocked as an “instant lawyer.” Ingles is the 2012 Bar topnotcher, teaches tax law at the Ateneo Law School, and authored a tax law reviewer used by students.

“I find it pretty funny, these people are more aware now of estate tax because of it,” said Ingles.

The Supreme Court in 1997 ordered the Marcoses to pay P23 billion in estate tax, an amount that is estimated to have reached P203 billion now because of surcharge, penalties and interest.

The other dominant defense of Marcos and his family is that estate tax is charged on the estate, and not the person.

This was debunked by no less than the country’s former tax chief, Kim Henares, who explained in an 1Sambayan forum Thursday, March 24, that the estate cannot be legally transferred to the heirs unless the heirs pay the tax.

Marcos Jr and mother Imelda are the court-approved executors of the late dictator’s estate.

“Kung nakapangalan ‘yun sa namatay, hindi ho ‘yan puwedeng ilipat hangga’t hindi po kayo nag–file ng estate tax return, at kung may buwis, babayaran muna ‘yun bago maglalabas ang BIR (Bureau of Internal Revenue) ng certificate authorizing registration” Henares said.

(If the property is under the deceased’s name, it cannot be transferred unless you file an estate tax return, and if there is tax, you need to pay it before the BIR can give you a certificate authorizing registration.)

Henares said she is supporting Senator Panfilo Lacson, not the 1Sambayan-endorsed Vice President Leni Robredo, for president. However, she is speaking up because “para sa akin ang pinaka madaling weapon panlaban sa fake news ay truth (for me, the easiest weapon against fake news is truth.)”

What is estate tax?

Estate tax is imposed when someone dies and that person’s estate is transferred to an heir. This means it is not paid every year like income tax, contrary to one other narrative being spread.

The most that the Marcos camp has said about this was a March 3 statement from spokesperson Vic Rodriguez who said Presidential Commission on Good Government (PCGG) and BIR had agreed to hold collection as they continue litigation of properties.

This had been debunked by both PCGG and BIR. President Rodrigo Duterte’s tax chief Caesar Dulay confirmed they sent the last demand letter on December 2, 2021.

On the sidelines of a sortie in Cavite on March 22, Marcos walked away from an interview after a journalist asked him if his family has paid this estate tax.

What complicates the matter is that the PCGG continues to run after properties of the Marcoses, and re-convey it to the government.

Ingles said even if PCGG wins some properties, it wouldn’t be considered the payment for the estate tax.

“The job of the PCGG is not to collect taxes, but the BIR’s. It’s totally different. If they sequester properties, the Supreme Court decision in 1997 which says the assessment is final and unappealable still remains, regardless if PCGG collects sequestration, kasi wala namang kinalaman ‘yun sa pagbayad ng taxes (because that is unrelated to payment of taxes.)

File a criminal case

Retired Supreme Court justice Antonio Carpio said there is now basis to file a criminal case against the heirs, particularly Marcos Jr who is the executor.

“Under Section 255 of the tax code, if you are legally obliged to pay the tax and you willfully refuse to pay the tax, you are criminally liable up to ten years imprisonment. That’s why I am saying, if the BIR, if it wants to now, can file a criminal case and I think it’s time,” said Carpio in the Thursday 1Sambayan forum.

“Ano pa hinihintay ng BIR, file-an na ng criminal case (what is the BIR waiting for, file a criminal case), that is the last thing they can do,” said Carpio.

Henares said she did not file a criminal case during her time as BIR chief because it was a priority of the Aquino government to collect as much taxes as it could.

“Kung nag-file kami wala na kaming gagawin kundi sumagot kay Marcos, imbes na pinag-tutuunan ng pansin namin ang mag-kolekta ay wala na kaming gagawin kundi sumagot kay Marcos at narrative niya,” said Henares.

(If we filed we would not have been able to do anything else but answer Marcos, instead of focus on collecting, we would have just spent our time answering him and his narrative.)

Carpio said: “They cannot collect the tax just by sending a demand letter because 25 years have passed and nothing happened, it’s time to enforce it by a criminal case, that is the last step.”

Ingles pointed out that the Marcoses had a chance to contest the assessment, but they didn’t, or even pay as early as 1997 so that it didn’t balloon to P203 billion. Henares added they also could have filed for amnesty to be able to cut the assessment in half.

“Why whould we borrow and ask Filipinos to pay debt to the World Bank and the ADB when we can collect from people who owe government, and these people are not poor, they are spending billions of pesos to run for president,” Carpio said. – Rappler.com

Add a comment

How does this make you feel?

![[Newspoint] Improbable vote](https://www.rappler.com/tachyon/2023/03/Newspoint-improbable-vote-March-24-2023.jpg?resize=257%2C257&crop=339px%2C0px%2C720px%2C720px)

![[Newspoint] 19 million reasons](https://www.rappler.com/tachyon/2022/12/Newspoint-19-million-reasons-December-31-2022.jpg?resize=257%2C257&crop=181px%2C0px%2C900px%2C900px)

![[In This Economy] Is the Philippines quietly getting richer?](https://www.rappler.com/tachyon/2024/04/20240426-Philippines-quietly-getting-richer.jpg?resize=257%2C257&crop=194px%2C0px%2C720px%2C720px)

![[OPINION] If it’s Tuesday it must be Belgium – travels make over the Marcos image](https://www.rappler.com/tachyon/2024/04/tl-travel-makeovers-marcos-image.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] Are cross-border services taxed in the Philippines?](https://www.rappler.com/tachyon/2024/02/bpo-workers.png?resize=257%2C257&crop=72px%2C0px%2C785px%2C785px)

![[Ask the Tax Whiz] Ease of paying taxes law: What you need to know](https://www.rappler.com/tachyon/2023/02/calculate-february-22-2023.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.